See your Settle financing power*

Curious how you can scale your brand on your terms with non-dilutive, transparent working capital? Discover your eligibility estimate with our simple calculator.

Revenue

Gross margin

Typical eCommerce gross margin is 20%.

Let's turn this into growth

What makes Settle different and how to take the next step with confidence

Why brands go with Settle

Ways to put your funds to work

What to expect next

Ready to get funded? Connect with our team to get started.

Get startedFrequently asked questions

How does Settle determine my credit limit?

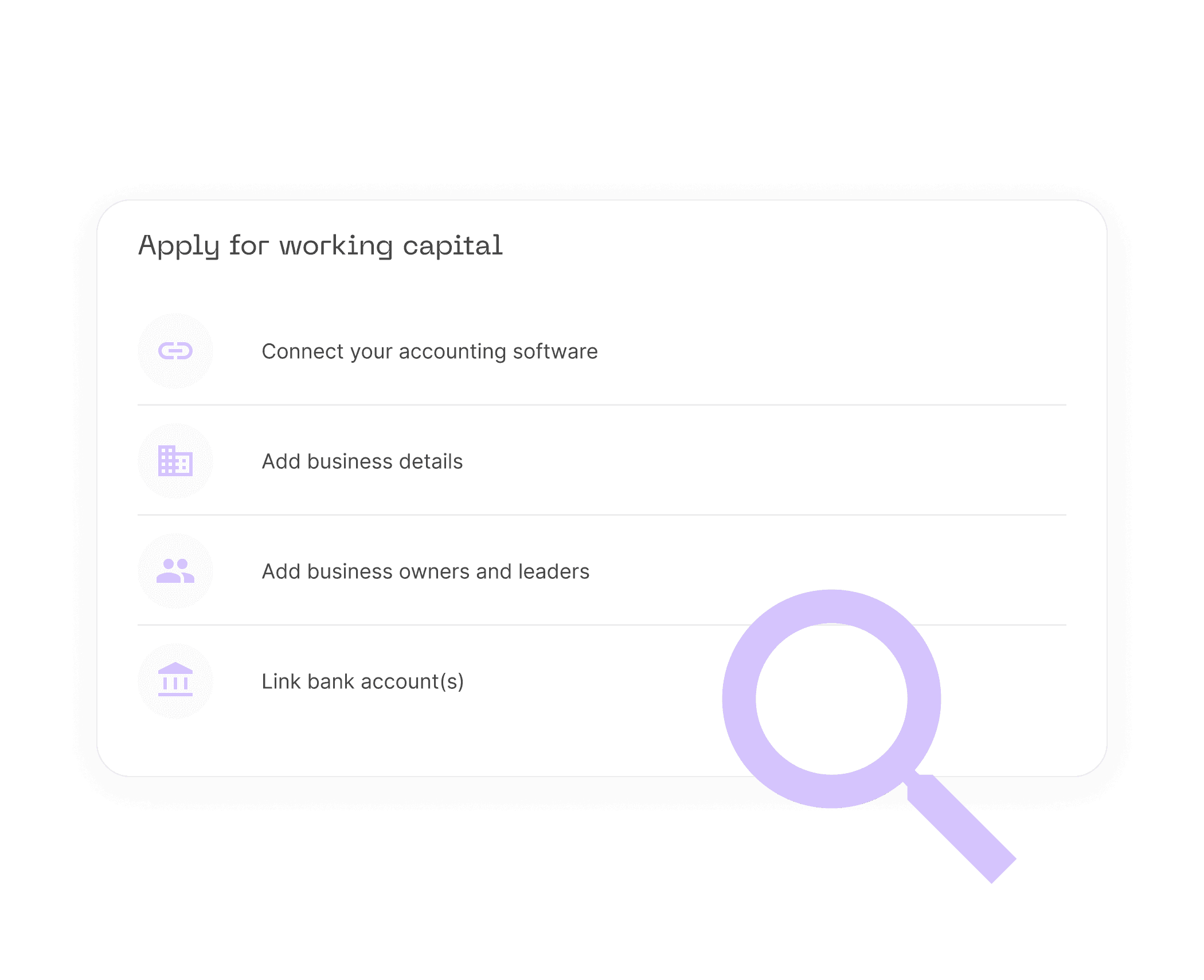

Settle offers financing to help businesses manage inventory and cash flow. In providing credit eligibility, here are a few baseline requirements we typically look for:

- At least 1 year of business history

- $300,000+ in revenue over the past 12 months

- Signs of growth

- U.S.-based and financially sound

We review this by connecting to your accounting software to review information like your Profit & Loss Statement and Balance Sheet. Note, the estimate provided here is not an application for credit or that credit eligibility amount, you have to submit an application and be approved.

Didn’t qualify last time? If your financials have improved, you’re welcome to reapply.

Think you may be eligible for an exception? We’re happy to talk. See full qualification detailshere.

How fast can I get the funds?

Once you apply for Settle’s Extended Payment Terms (EPT) and connect your accounting and bank data, most approvals are able to be completed within 1–3 business days.

After you're approved and accept your offer, you can start financing invoices right away.

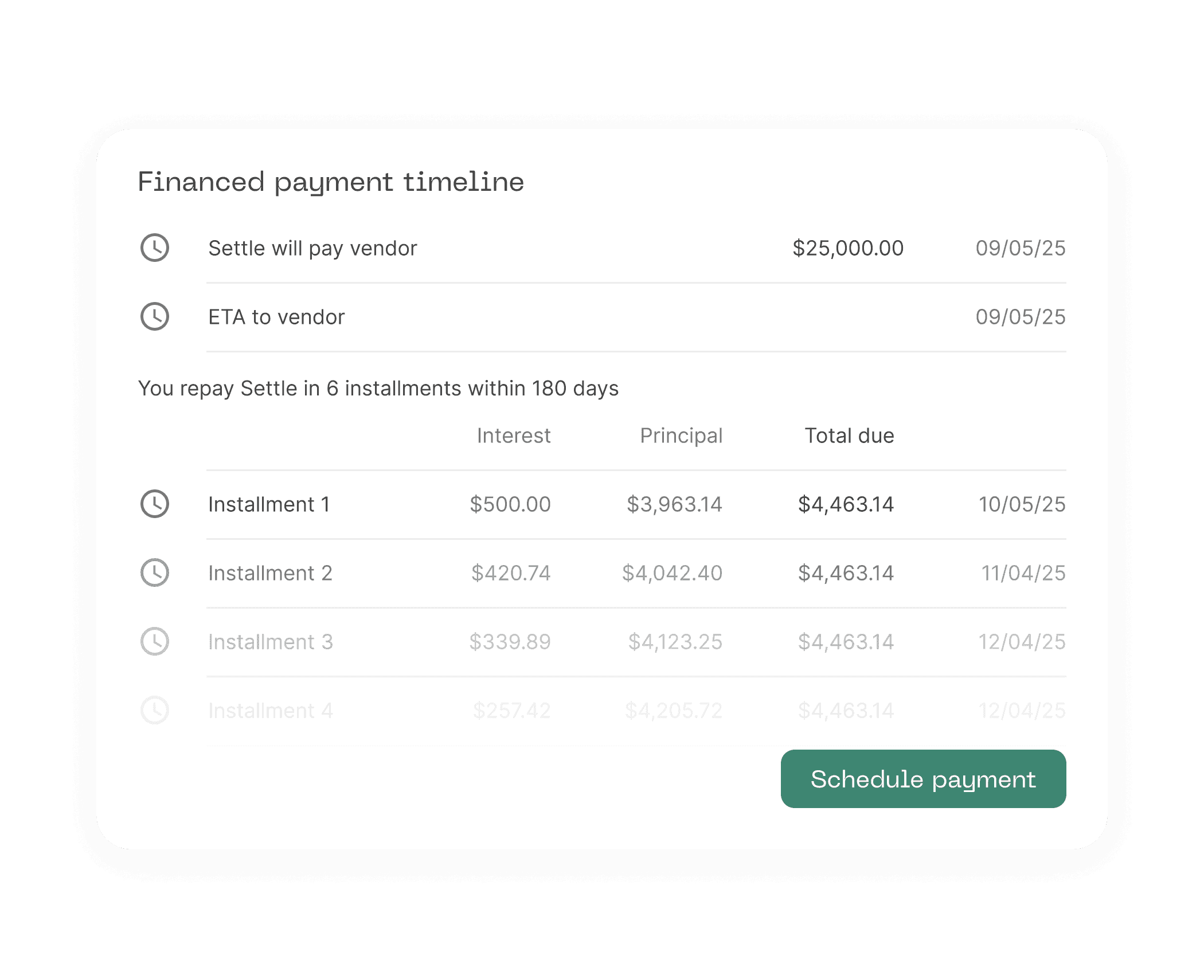

The time it takes for your vendor to receive the payment depends on the method, amount, and their location. You'll see a delivery estimate in your dashboard when scheduling a specific payment which will be the most accurate, and your vendor will receive confirmation with that timing.

Example delivery times:

- ACH (domestic): 1 business day

- Wire (domestic): 1 business day

- Wire (international): 1–4 business days

Paper check (domestic): 3–8 business days

Didn’t qualify last time? If your financials have improved, you’re welcome to reapply.

How can I improve my estimate?

Revenue growth and healthy financials can increase your financing eligibility. Here’s what to focus on:

- Revenue growth: Aim for steady sales increases

- Gross margin: Track product profitability and reduce costs where possible

- Liquidity: Maintain healthy cash flow and operating runway

- Cash conversion cycle: Shorten the time between paying vendors and collecting from customers

- Debt balance: Keep a balanced mix of debt and equity

The good news? Settle gives you the tools to help manage these areas. From inventory planning to vendor payments, we’re built to help you operate more efficiently and drive profitability.

Didn’t qualify last time? If your financials have improved, you’re welcome to reapply.

👉Explore the platform

👉Read our guide to business financial health