Black Friday and the holiday season are pivotal moments for e-commerce brands. With 2025 bringing economic uncertainty, rising tariffs, and rapidly evolving consumer behavior, preparation has never been more important. In this guide, we share insights from e-commerce leaders, operational strategies, and actionable tips to help you succeed this Black Friday and Q4, while setting up a strong start for Q1.

This guide is based on learnings from Settle's recent webinar Black Friday, Conquered: E-Commerce Holiday Planning for 2025 featuring Sumish Khadka, COO at HigherDOSE, and Jon Blair, Founder at Free to Grow CFO.

Watch the full recording here.

State of the Market: Navigating Economic Turmoil in 2025

The 2025 e-commerce landscape is defined by economic uncertainty, supply chain challenges, and shifting consumer expectations. Brands are facing:

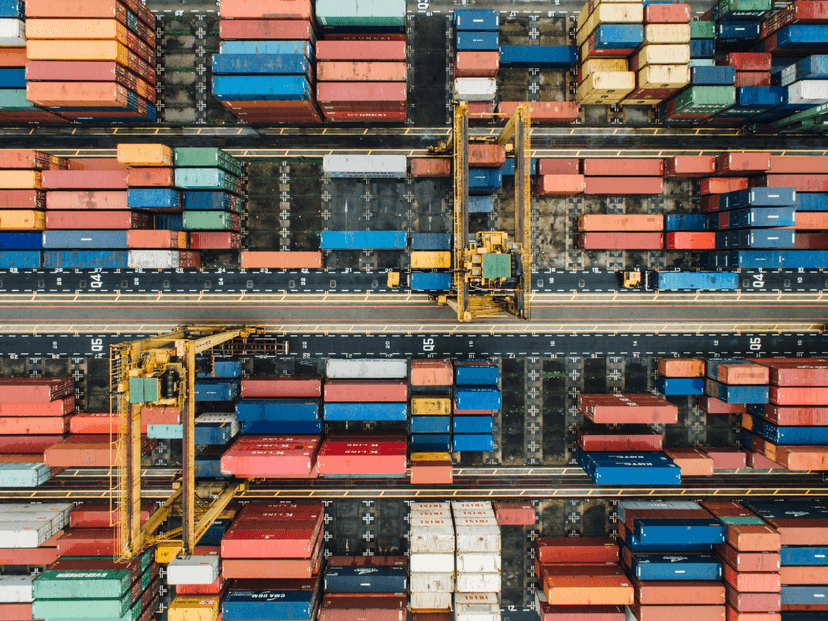

- Tariff fluctuations affecting imported goods, especially products manufactured in China. Advanced planning and negotiating favorable payment terms can help manage cash flow during periods of high tariffs.

- Inflation and cautious consumers which can affect discretionary spending and the success of promotions.

- Shifts in digital behavior, with more consumers using AI tools like ChatGPT to research products instead of traditional search engines. Brands need to adjust marketing and content strategies to stay visible.

As Sumish Khadka explained in our webinar, "Consumers are more educated than ever. They aren't just clicking on a Facebook ad—they want science-backed information and clear guidance on how to use the product."

Practical Tip: Monitor tariff updates and integrate scenario-based forecasting for inventory and cash flow. Use Labor Day performance data to anticipate Black Friday and Cyber Monday demand, and do the same with Q4 performance data for Q1 forecasting. This is especially important for imported products affected by tariffs or seasonal production shutdowns.

Ad Spend and Customer Acquisition Strategies

Maximizing Black Friday success requires more than simply increasing ad spend—it starts with understanding which "game" your brand is playing. Jon Blair highlighted three common scenarios that dictate strategy and risk tolerance:

- High-LTV products (subscriptions, consumables): These brands can acquire customers at break-even or even a slight loss because their lifetime value will generate profit over time. Promotions and aggressive ad spend can be leveraged strategically to grow the customer base during peak season.

- Apparel / High SKU brands: With multiple SKUs and frequent product launches, the focus is on efficient new product introductions while carefully managing customer acquisition costs (CAC). Overspending on ads for low-performing items can erode margins quickly during Black Friday.

- Durable goods / New customer-dominant: These brands must make money on new customers immediately, as repeat purchases in the first 3–6 months are limited. Every ad dollar must be justified by immediate conversion potential.

Jon advises, "Assess the game, determine if you need to make money on new customers, and align ad spend and CAC thresholds accordingly."

Operational Insights from the Front Lines

Sumish shared how HigherDose manages Q4 ad spend with daily stand-ups and real-time operational oversight. Their approach combines marketing, operations, and customer feedback into a tightly coordinated loop:

- Daily Q4 check-ins: Ad performance, conversion metrics, and inventory levels are reviewed every day during the holiday season to quickly identify opportunities or issues.

- Customer feedback integration: Insights from support channels help optimize campaigns. For instance, if a sauna blanket ad is generating clicks but low conversions, feedback revealed that 9% of users didn't know how to plug it in. Marketing responded by creating a video tutorial on the product page, directly addressing the barrier and boosting conversions.

- Product-level prioritization: Ad spend is allocated according to inventory turnover and expected demand, ensuring marketing dollars support products that can actually be delivered and sold.

This combination of daily monitoring, rapid feedback loops, and strategic ad allocation allows brands to maximize revenue during the critical Black Friday window while minimizing wasted spend.

Practical Tips for Black Friday Ad Spend

- Diversify across channels: Don't rely solely on Meta or Google. Include affiliate platforms, email campaigns, and retargeting strategies to capture demand across multiple touchpoints.

- Leverage customer insights: Continuously integrate support feedback and product-level performance data to fine-tune ad messaging and targeting.

- Align ad spend with inventory: Monitor inventory turnover ratios for each product and prioritize spend on items with available stock and high expected ROI.

- Test promotions early: Launch smaller test campaigns to gauge interest, optimize messaging, and adjust CAC thresholds before the peak shopping days.

- Monitor and adjust daily: Black Friday is dynamic. Daily reviews of spend, conversions, and stock levels allow rapid pivots to maximize revenue and reduce wasted ad spend.

By combining strategic planning with operational oversight and customer insights, brands can turn Black Friday into a revenue-maximizing opportunity while ensuring ad spend is targeted, efficient, and tied to inventory realities.

Inventory Management, Cash Flow, and Q4 Planning

For e-commerce brands, Q4 is make-or-break. Decisions around inventory and cash flow during Black Friday and the holiday season directly impact sales performance, ad efficiency, and overall profitability. Both Sumish and Jon emphasized that the key to a successful Q4 lies in proactive planning, precise monitoring, and strategic financial alignment.

Advanced Planning: Timing is Critical

High-demand periods like Black Friday require careful forecasting. Brands must anticipate which products will drive the most revenue, which may need promotional support, and which could risk overstock.

Sumish explained, "You are gambling on Q4 while simultaneously gambling on Q1. Different financing terms and extended supplier payments help manage that risk."

Even within Q4, certain products may require early manufacturing or shipment planning to meet peak demand. Understanding lead times and ensuring inventory availability before major shopping days like Black Friday and Cyber Monday is essential.

Payment Terms & Financing: Avoid Cash Flow Crunches

Aligning financing with Q4 inventory needs ensures that ad spend and promotions don't create cash strain.

Jon highlighted, "Assess the game, determine if you need to make money on new customers, and align ad spend and CAC thresholds accordingly."

Brands that overspend on ads for products they don't have in stock, or rely on short-term debt to fund inventory, risk running into cash flow issues during the busiest sales weeks. Longer-term financing or extended supplier terms provide the flexibility to stock key items and respond to market demand without overextending.

Inventory Insights: Data-Driven Q4 Decisions

Operational metrics like product-level inventory turnover are crucial during Black Friday and Q4. Sumish shared how HigherDose manages inventory in real time:

- Daily Q4 check-ins: Monitor ad performance, product-level sales, and inventory ratios to ensure marketing dollars are driving profitable conversions.

- Cross-functional collaboration: Operations and marketing teams share metrics to align ad spend with available inventory. For instance, overstocked products can receive a marketing push, while low-stock items are promoted more conservatively.

Practical Tips for Black Friday & Q4

- Negotiate flexible supplier payment terms: This ensures you can stock peak-demand products without tying up cash unnecessarily.

- Use bridging or strategic financing: Align repayment with the inventory cycle so cash flow remains stable during the busiest season.

- Track metrics daily: Monitor sales, ad spend, and inventory turnover in real time to make immediate adjustments.

- Prioritize marketing spend: Allocate budget toward products with available inventory and strong demand signals.

- Plan for contingencies: Account for shipment delays, unexpected surges in demand, and promotional performance fluctuations.

By treating Q4 as a tightly managed operational window, brands can maximize Black Friday and holiday season performance. Proper planning, daily oversight, and strategic financing not only protect cash flow but also ensure that marketing efforts are efficient and aligned with inventory realities.

AI, SEO & Content Strategy for E-Commerce

Consumer behavior is changing fast. AI-driven search and content discovery are increasingly replacing traditional Google searches. Brands must rethink how they stay visible:

- Invest in educational content: Blogs, podcasts, and newsletters build authority and improve discoverability through AI-driven searches.

- Leverage AI to optimize presence: Use large language models (LLMs) to understand search intent, find content gaps, and enhance product descriptions.

- Build brand credibility through research-backed content: HigherDose invests in clinical studies to strengthen product credibility and long-term consumer trust.

- Affiliate Platforms & Review Systems: Word-of-mouth remains one of the most reliable growth engines for e-commerce. Affiliate networks and review platforms allow brands to leverage satisfied customers and brand advocates to drive additional sales. Integrating reviews into product pages or ad campaigns can improve credibility and conversion rates, while affiliate platforms extend reach without the fixed costs of paid media.

Jon notes, "Brands that rely purely on paid media will need to incorporate content strategy because AI tools like ChatGPT are surfacing content, not just ads."

Practical Tips:

- Create video tutorials and educational content to answer common customer questions.

- Publish podcasts or guest articles highlighting expertise in your niche.

- Use AI tools to identify trending questions and optimize content for LLM-driven searches

Recommended Tools for E-Commerce Success

Leveraging the right mix of software, analytics, and integrations allows brands to optimize ad spend, inventory management, and cash flow while reducing manual work and errors.

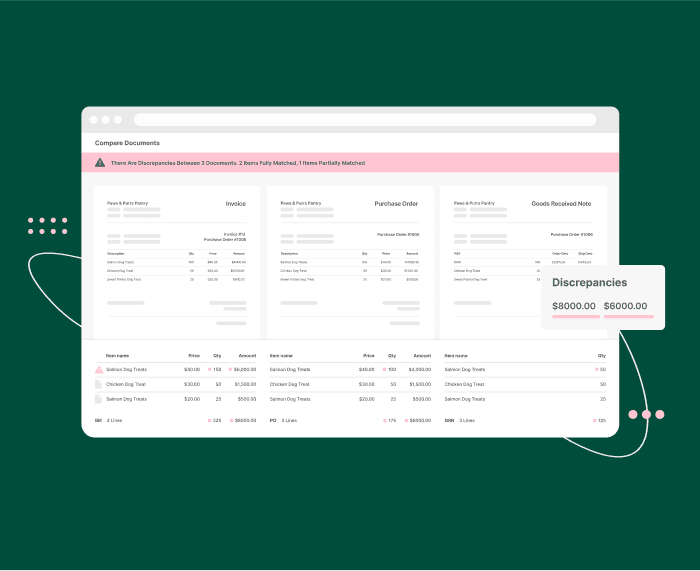

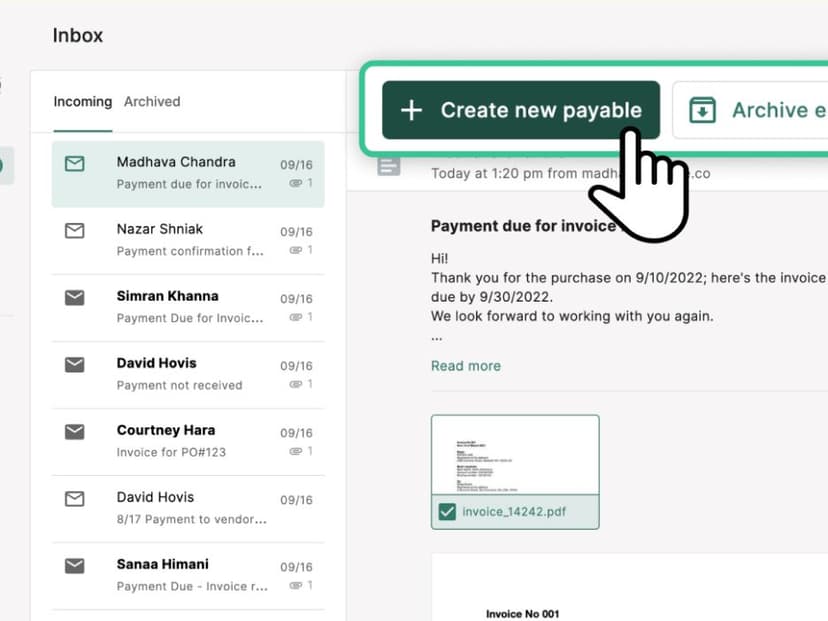

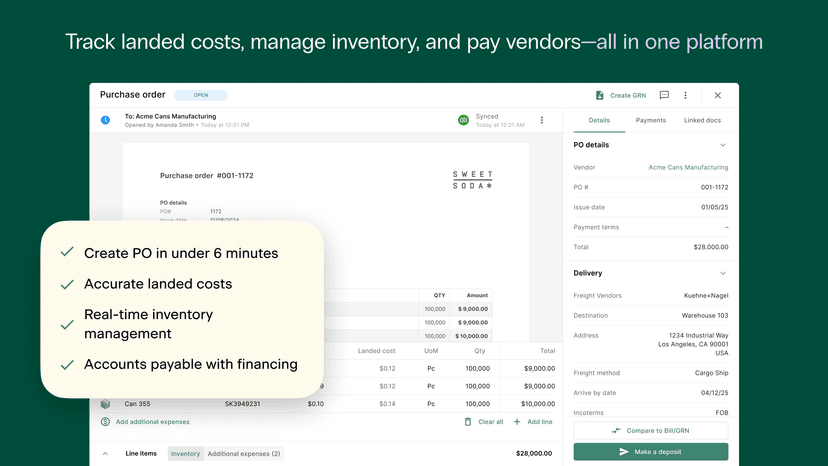

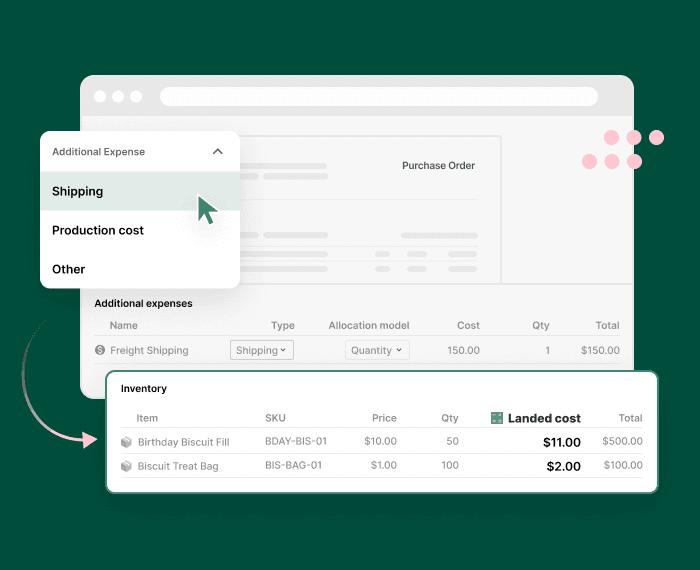

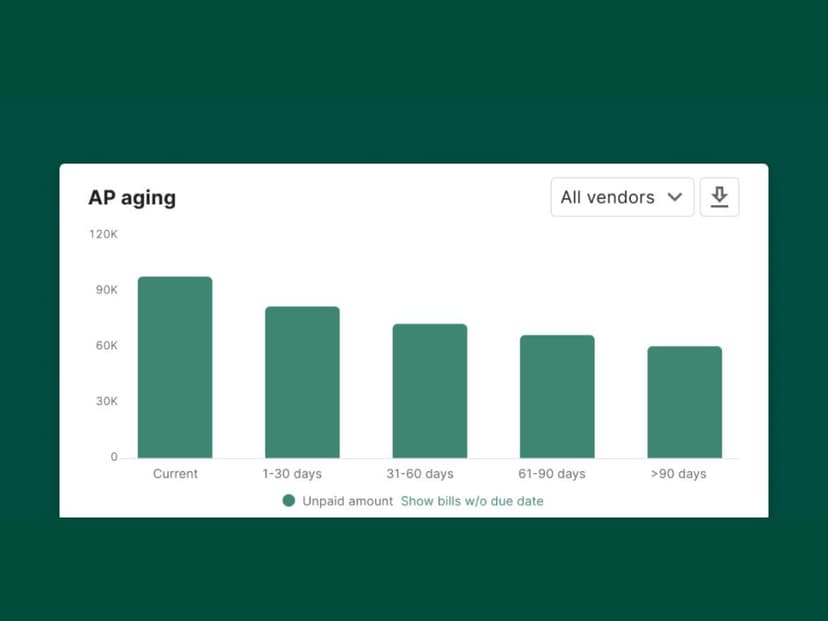

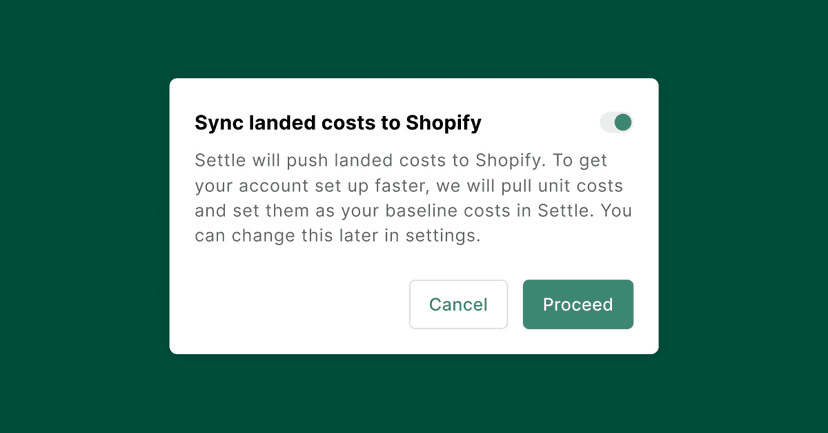

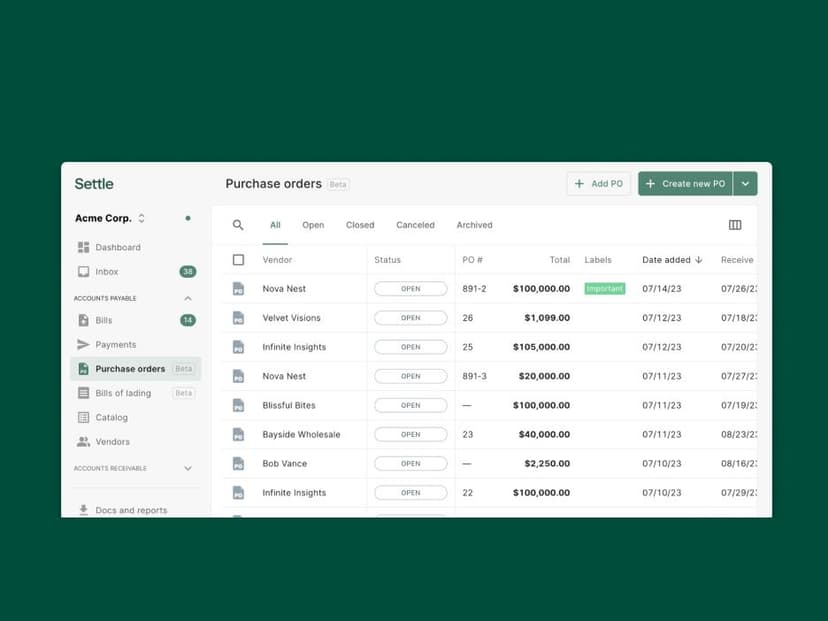

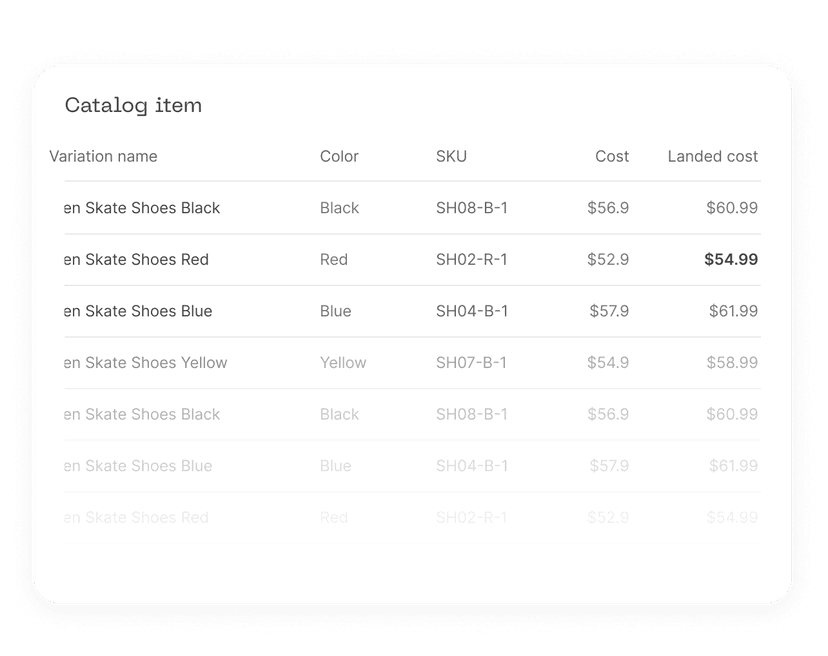

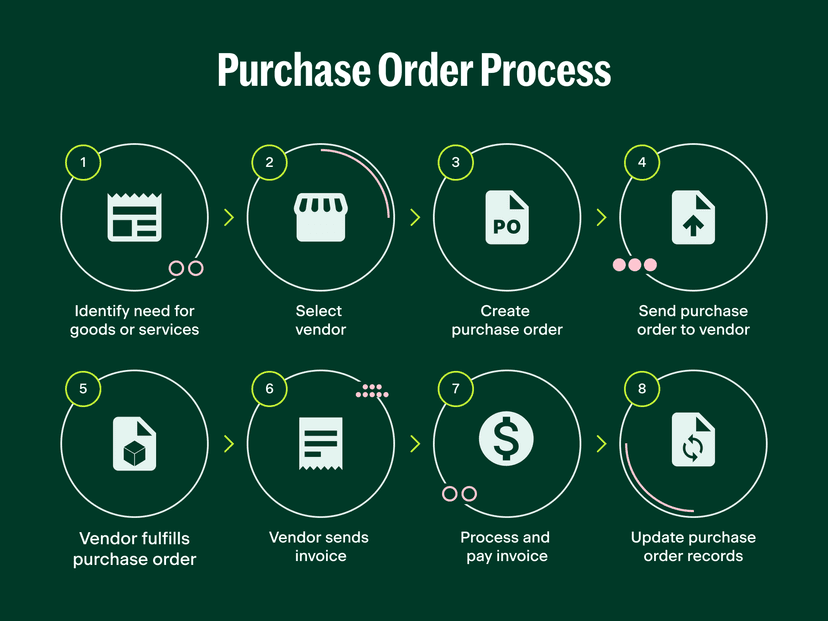

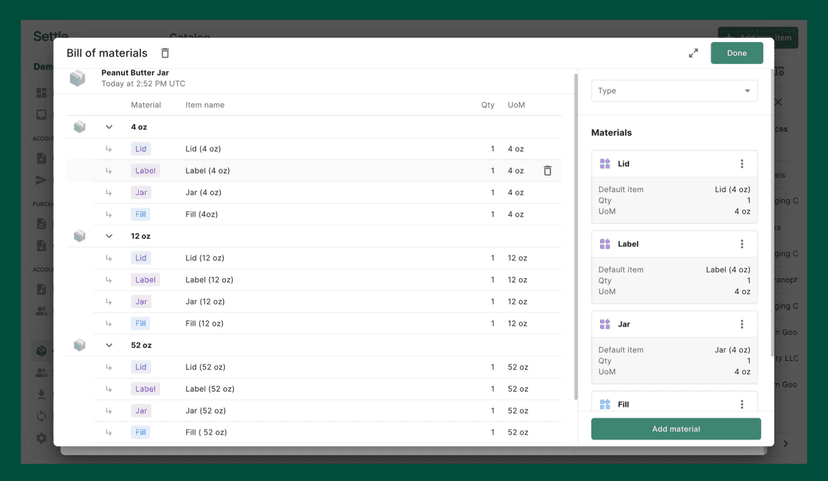

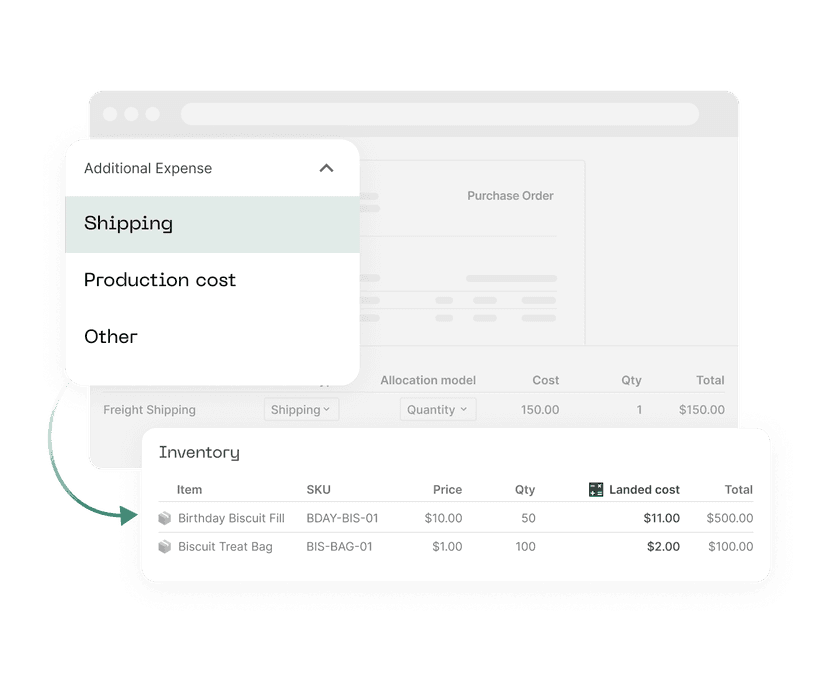

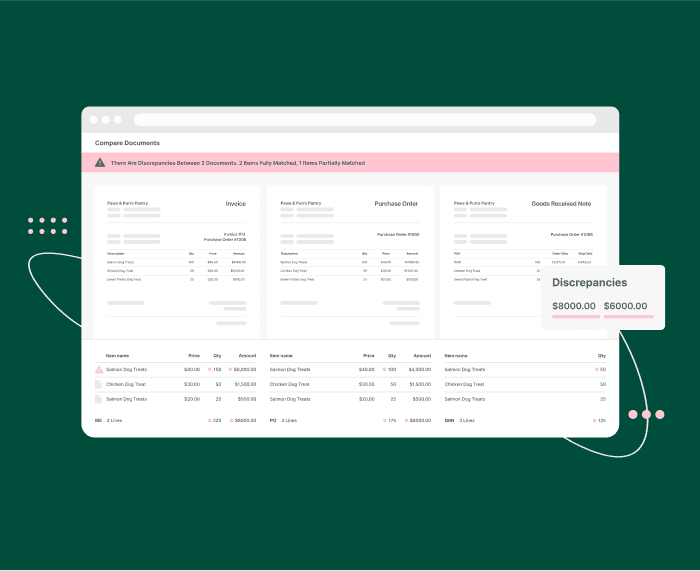

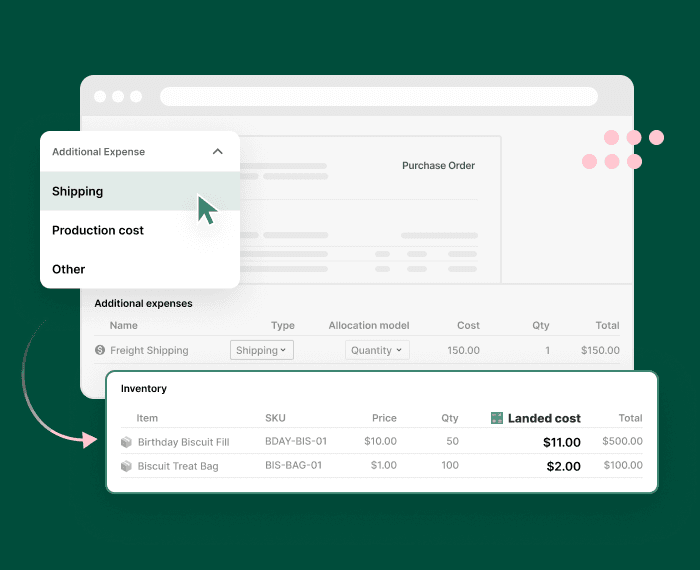

Settle: Settle supports purchase order financing, inventory management, landed cost tracking, and AP workflows—all essential for ensuring you can stock the right products, pay suppliers on time, and avoid cash flow bottlenecks during peak seasons.

Excel + AI Integrations: While Excel remains a staple for analysis and scenario planning, AI-enhanced integrations can dramatically increase efficiency. By automating data extraction from ad platforms, financial systems, and inventory databases, brands can build dynamic dashboards that help forecast demand, optimize ad spend, and anticipate inventory gaps.

Third-Party Logistics Partner: For e-commerce brands looking to scale, the right third-party logistics (3PL) partner is more than just a vendor. The right choice keeps operations running smoothly, improves delivery speed, reduces costs, and strengthens customer relationships. Check out our list of the top 10 here.

Sumish shared, "We primarily use Settle and also Excel tools, which have been instrumental for our capital planning and operational efficiency."

Practical Tips for Implementing Tools

- Automate reporting wherever possible: Daily or weekly automated reports for inventory, ad performance, and cash flow reduce manual errors and free up time for strategic decision-making.

- Integrate customer feedback into operations and marketing: Pull insights from reviews, support tickets, and surveys into dashboards to identify conversion blockers and optimize messaging.

- Test AI-powered dashboards: Explore tools that unify ad spend, inventory, and financial metrics in one place. This provides a holistic view of Q4 performance, helping you make faster, more informed decisions.

- Prioritize tools that scale with growth: During Black Friday, every minute counts. Choose platforms that can handle increasing traffic, transactions, and data without slowing down reporting or operational workflows.

- Use scenario modeling for peak season planning: Build financial and inventory models that simulate high-traffic events, helping to anticipate cash flow needs and identify potential bottlenecks before they occur.

By combining core platforms like Settle with smart Excel workflows, AI integrations, and robust review systems, e-commerce brands can optimize operational efficiency, minimize risk, and make the most of Black Friday and Q4 opportunities.

Conclusion

Black Friday and Q4 success comes from balancing ad spend, inventory, operational alignment, and AI-informed content strategy. By leveraging insights from industry leaders, negotiating smart financing, and adapting to economic conditions, your brand can maximize holiday season performance and start Q1 strong.

Check out Settle to crush your Black Friday and Cyber Monday by automating inventory management, procurement, and payments—while also gaining access to built-in working capital.