New Feature3 min read

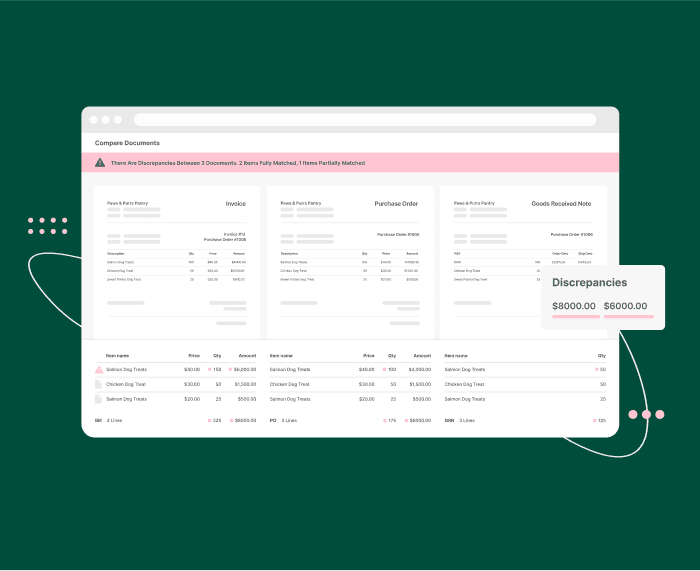

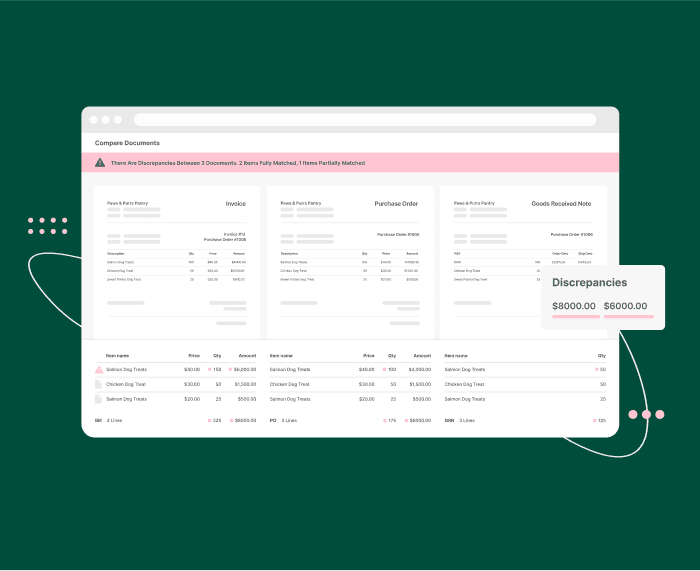

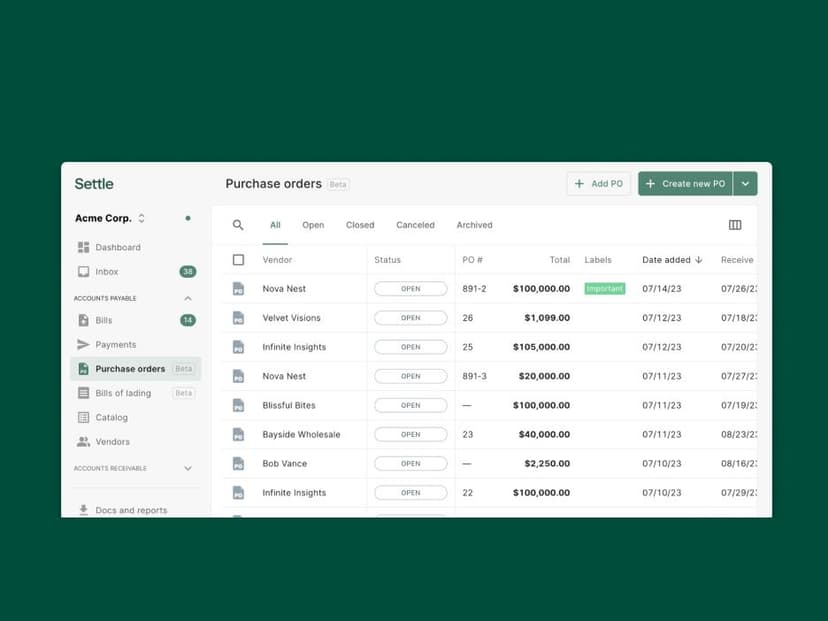

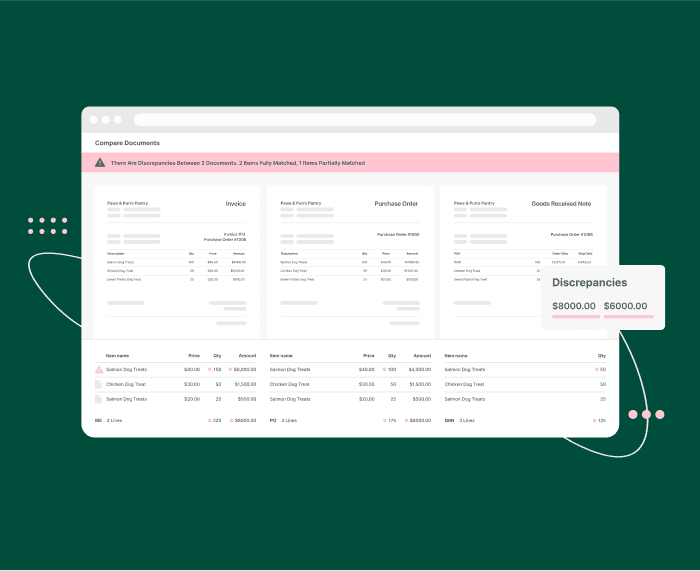

Introducing: Automatic 3-Way Matching

We're taking another step in transforming procurement for inventory businesses

Learn12 min read

The Ultimate Guide to Black Friday for E-Commerce Brands

Get expert strategies to navigate Black Friday 2025—covering ad spend, inventory, cash flow, and AI-driven marketing—so your e-commerce brand can maximize Q4 sales and start Q1 strong.

Company News2 min read

Where Brands Grow Fearlessly: Settle's Mission to Empower Independent Brands

Behind every bold brand is a founder with a big idea. But growth takes more than that. It takes clarity in the chaos, confidence in uncertainty, and the right tools to keep moving, no matter the market. That's why we built Settle—to empower the people behind the brands shaping our world.

Learn7 min read

7 Tips to Prepare for Your Next CPG Trade Show

Discover 7 actionaable tips on how to prepare for a trade show, including pre-planning and effective promotion strategies for success.

Learn9 min read

Settle Spotlight Series: Q&A with Vividly

We sit down to chat with Alyshah Walji from Vividly, a trade promotion management (TPM) software built by and for the consumer packaged goods industry.

Learn6 min read

A Guide To Inventory Management for CPG

Learning to navigate inventory management can be a tricky part of growing your brand. Check out our guide to inventory management to find out more about it.

Learn5 min read

Accounts Payable vs. Accounts Receivable

Understanding accounts payable and accounts receivable is an essential part of business workflow. So how do they differ? Learn more about them in this guide.

Learn6 min read

4 Types of Capital Every CPG Brand Should Know About

Capital is critical to running a modern business. Here are the four fundamental types of capital and how they can work for a small business.

Learn7 min read

6 Social Media Marketing Tips for eCommerce Brands

Marketing directly to consumers through social media is one of the most important ways businesses can reach out to their audiences. This is how.

Learn4 min read

The Ultimate How-To Guide for Selling Products on Amazon

Many direct-to-consumer and eCommerce brands have begun selling products on Amazon because it's convenient and customer-friendly. This guide tells you how to do it.

Learn7 min read

What Is Amazon FBA and Is It Right For You?

Using Amazon FBA is a great way for companies to expand their scalability and fulfillment abilities. Here is how it works, and how businesses can benefit from it.

Learn6 min read

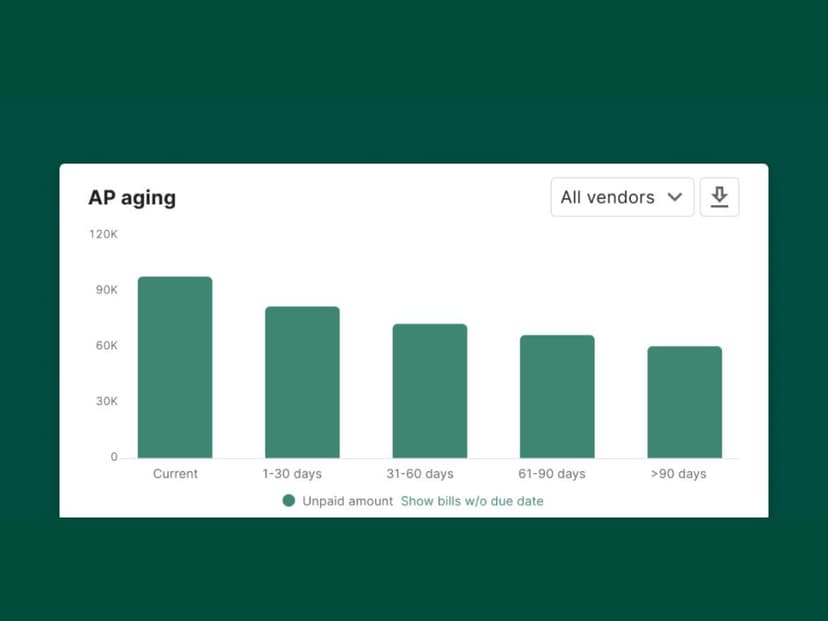

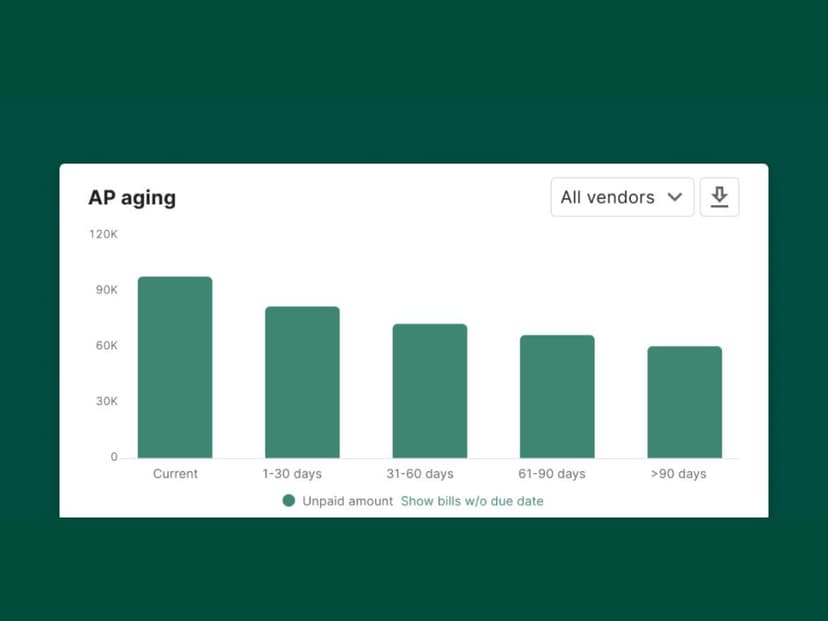

What is an A/P Aging Report?

The Accounts Payable Aging Report is an essential tool for businesses with a large number of accounts payable to track. Here's a general breakdown of A/P Aging Reports.

Learn5 min read

What Are the Consequences of Equity Dilution?

Equity dilution can be a very concerning process for shareholders who are unfamiliar with its consequences. This is how to avoid equity dilution and keep stocks healthy.

Learn4 min read

What Are Net Terms?

Making use of net terms can enable both buyers and vendors to increase their profitability and sales dramatically. This is what net terms are.

Learn5 min read

Market Expansion: A Guide to Selling Wholesale

Selling wholesale is one of the most important steps that a small business can take towards greater success. This is how any startup can do exactly that.

Learn5 min read

Choosing a Distribution Partner for Your CPG Brand

Distribution partners are some of the most important parts of scaling up a small business or startup. This is what they are and how they can help small businesses.

Learn3 min read

The Basics of Cash Flow Management: Forecasting, Analyzing, and Improving Cash Flow

Understanding good cash flow management is critical for managers. Without proper systems in place, many businesses end up failing.

Learn4 min read

Accounts Receivable Factoring 101

Accounts receivable factoring can help companies can improve their financial stability and cash flow. We'll explain what it is and how it's beneficial in our guide.

Learn6 min read

Operating Cash Flow (OCF): What It Is and How It's Determined

Discover the cash flow metric that can make or break a business

Learn6 min read

Invoice vs. Receipt: What's the Difference?

Invoices and receipts are similar in concept, but differ in the details. Here's what differentiates invoices from receipts, and why it's important to understand.

Learn6 min read

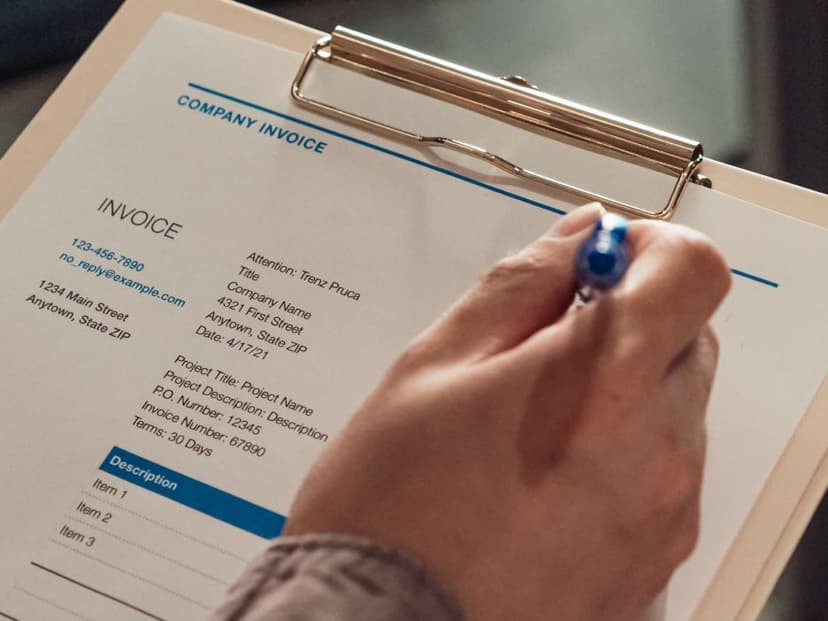

How to Create an Invoice

Creating invoices can be tedious, especially for new businesses processing everything manually. Learn how to create invoices effectively and efficiently with this detailed guide.

Learn7 min read

Non-Dilutive Funding Guide for CPG Brands

A popular source of funding is financing from angel investors and VCs. Yet many companies fail to recognise non-dilutive funding — where no ownership is lost.

Learn7 min read

How Long Does a Wire Transfer Take

Wire transfers can be the quickest method of exchanging funds. Knowing how long it takes can help determine whether wire transfer is the best solution.

Learn7 min read

ACH vs Wire vs Electronic Transfer: What is the Difference and How to They Work?

ACH, wire transfers, electronic transfers: What's the difference, and why does it matter? Learn more about how these work and what they mean for your business.

Learn4 min read

What is the Accounts Payable Process?

Accounts payable (AP) refers to all the payments that a business owes its suppliers and creditors. Neglecting your accounts payable process can lead to production and supply issues.

Learn4 min read

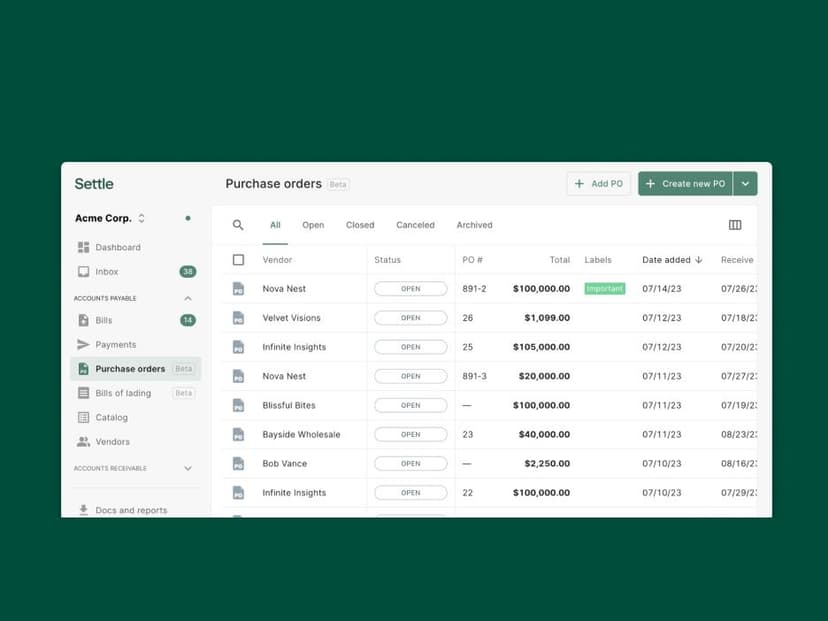

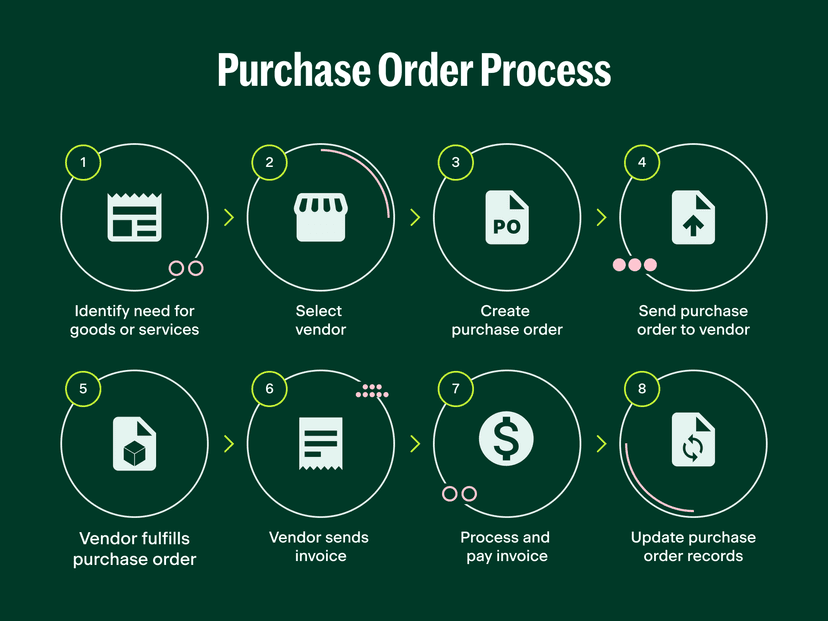

How Purchase Orders Benefits Startups

Learn why start-ups should use purchase orders to streamline processes, track spending, and enhance financial management.

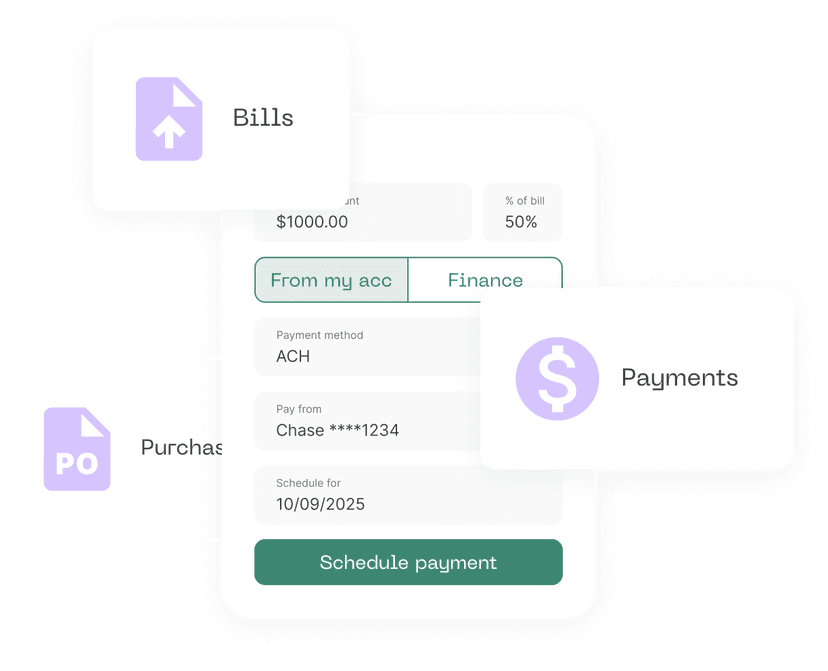

New Feature2 min read

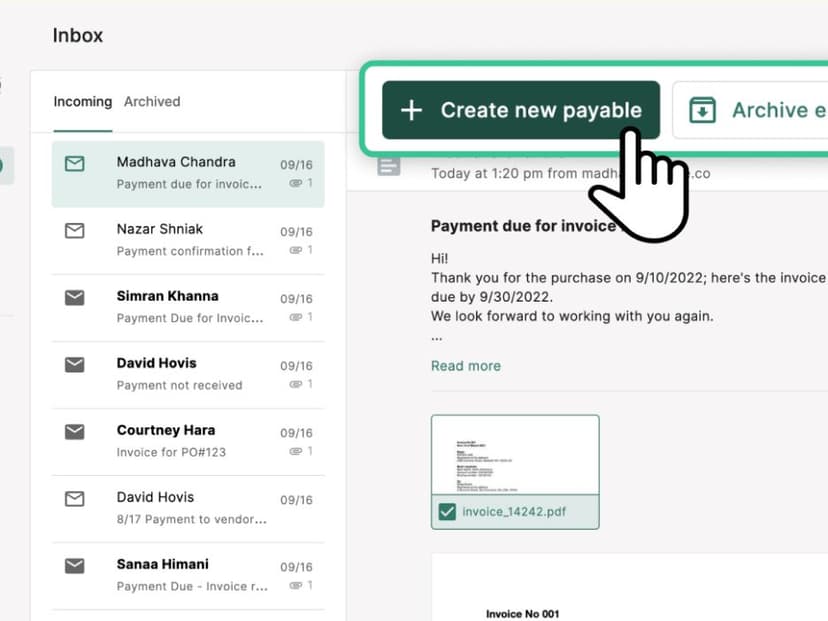

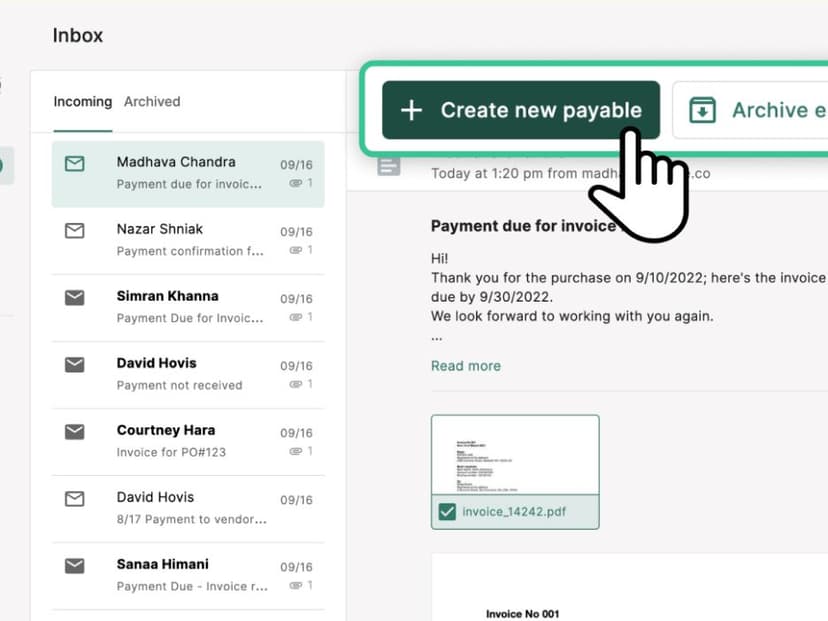

Say hello to Settle Inbox, a new way to manage your invoices

Settle Inbox is a better way for your team to triage invoices and messages from vendors.

Learn3 min read

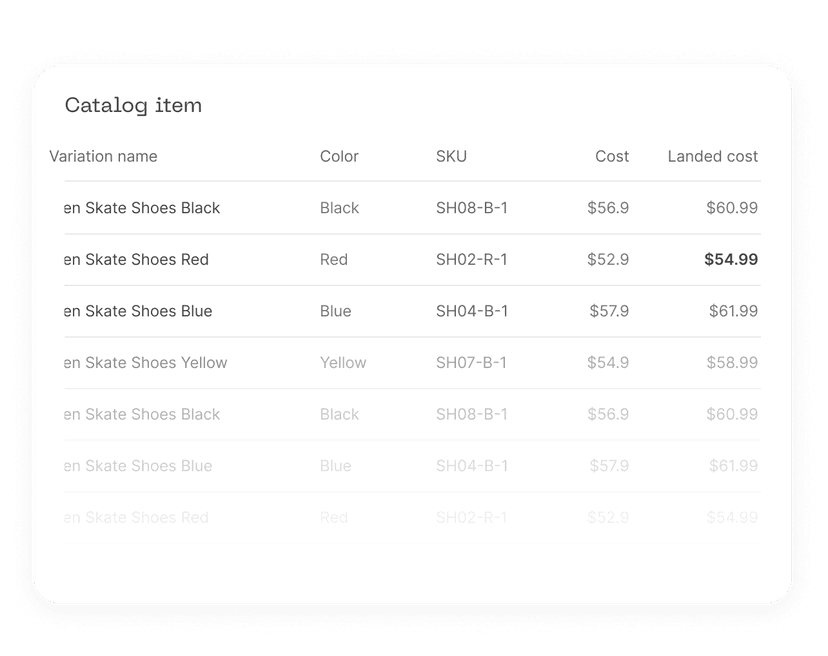

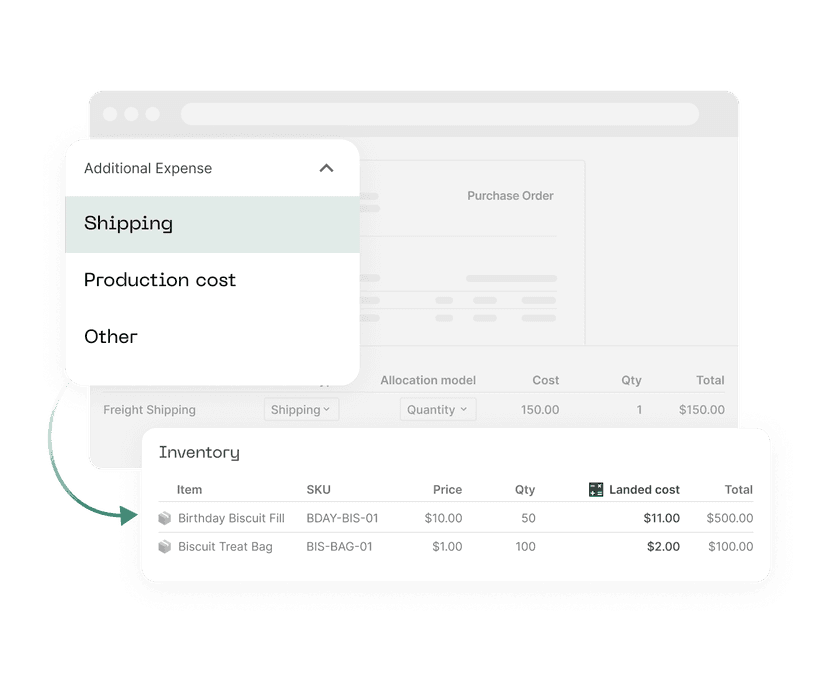

Why Cost Clarity Is the Missing Link for Scaling Shopify Brands

Struggling with margins or stockouts? Learn how real-time cost visibility helps Shopify brands track true COGs, improve cash flow, and scale with clarity.

Learn5 min read

How Homecourt Balances Cash Flow for a Successful 2025

Learn how Homecourt CEO Sarah Jahnke balances cash flow, optimizes SKUs, and navigates holiday surges. Discover tips for smarter forecasting and financial planning in 2025.

Learn8 min read

Most Important Metrics for Startups Seeking Financing

Every startup must eventually seek financing. Knowing what lenders and investors look for can help you prepare.

Learn3 min read

The Future of Accounting Workflows

Accounting firms are built to guide, but disconnected tools make it hard to lead. When client data lives across bill pay platforms, inventory systems, and email threads, your team spends more time chasing numbers than delivering insights. That inefficiency adds up—missed opportunities, delayed closes, strained capacity. The good news? Integrated platforms like Settle are changing the game, helping firms streamline workflows, deepen client value, and scale without burnout.

Learn4 min read

How to Prevent Duplicate Payments in Your AP Process

Learn how to prevent costly duplicate payments in your AP process and enhance efficiency.

Learn6 min read

What is the Cash Conversion Cycle?

A company's cash conversion cycle can speak volumes about its operational efficiency and financial stability. It can also determine whether people get paid on time.

Learn5 min read

Inventory and Cash Flow: Why CPG Brands Need Smarter Inventory Management to Scale

Many CPG brands use inventory planning and inventory management interchangeably, but they serve distinct roles. CPG and ecommerce brands need BOTH to stay profitable and sustainable.

Learn5 min read

How to migrate off BILL in 5 steps

Though migrating off BILL may seem daunting, we make it easy in this step-by-step guide.

Learn6 min read

5 Benefits of AP Automation for CPG

Discover the benefits of AP automation for CPG brands and 5 steps on how you can get started.

Learn4 min read

Approval Rules in Accounts Payable and Why They Matter

Discover the importance of robust approval rules in accounts payable and how they improve control, efficiency, and vendor relationships.

New Feature2 min read

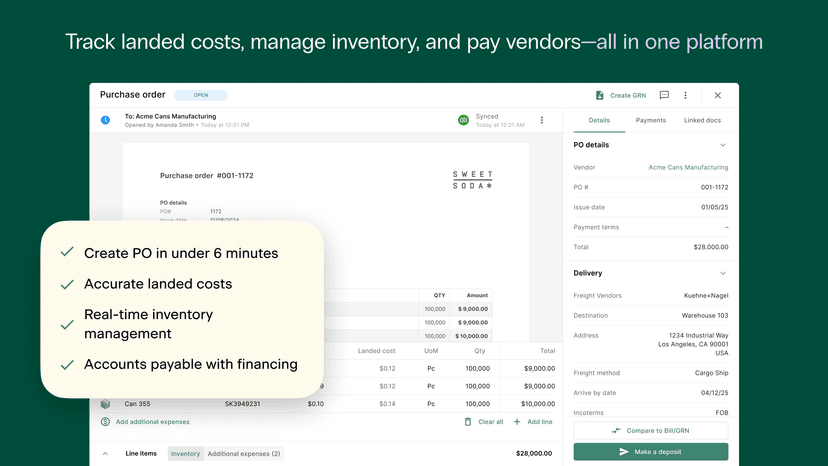

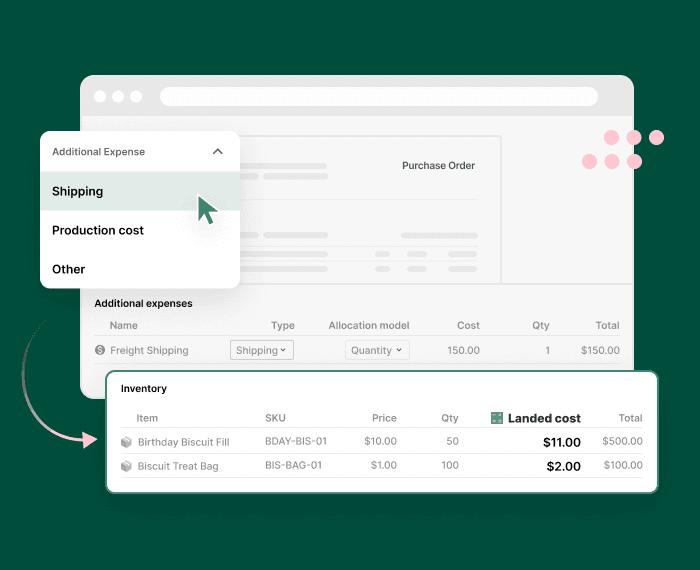

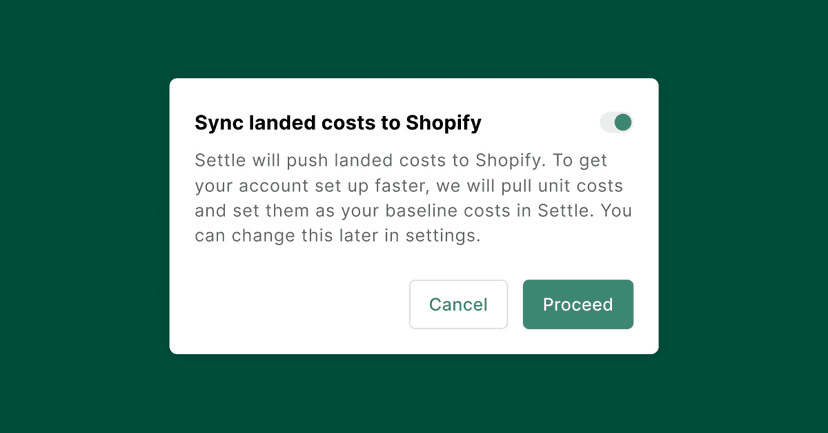

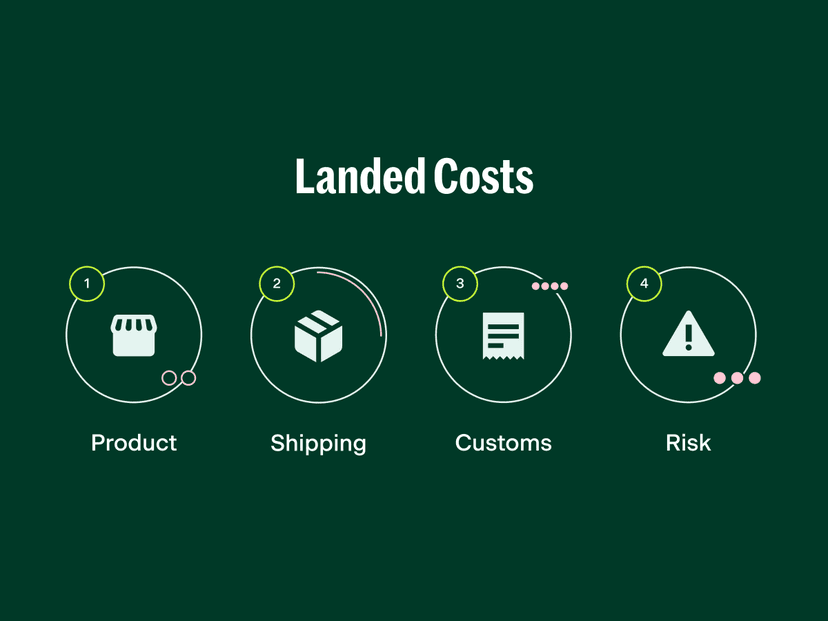

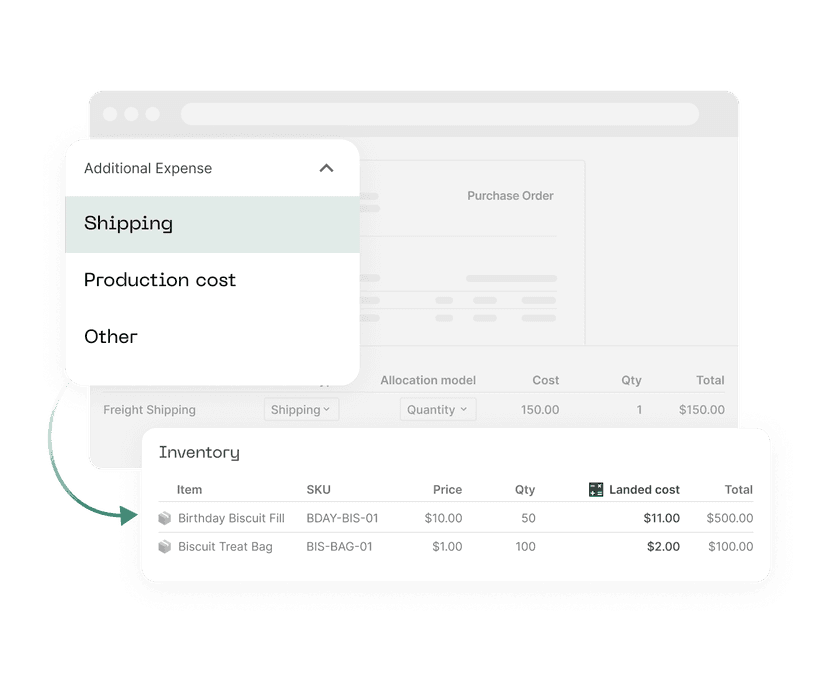

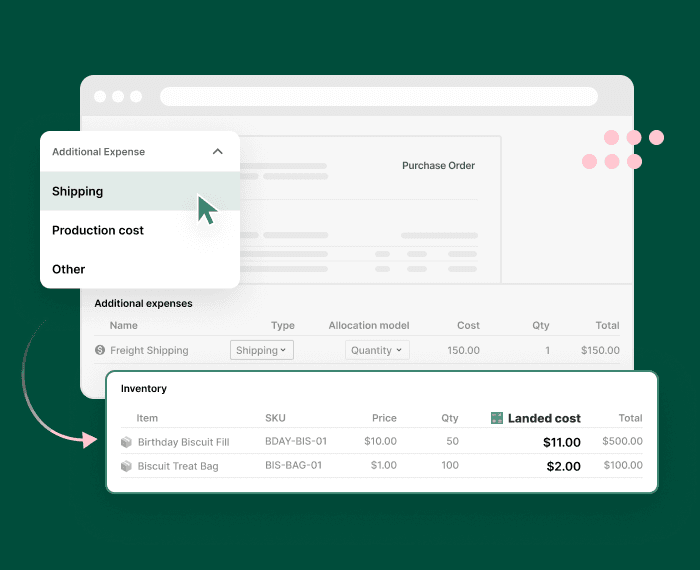

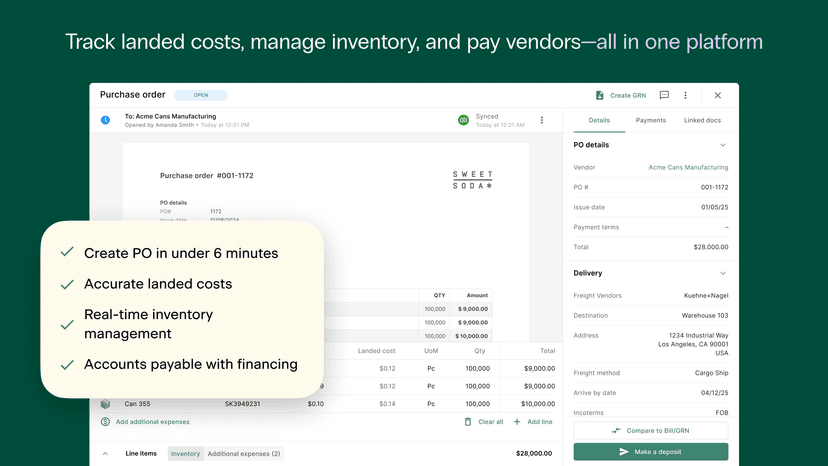

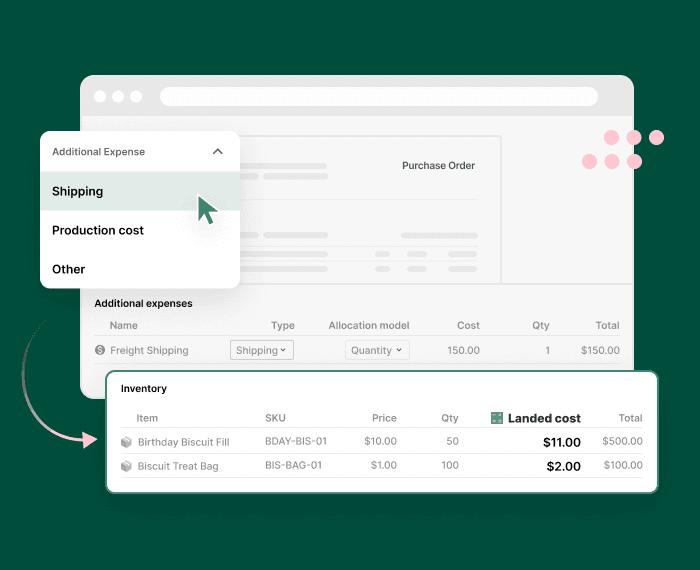

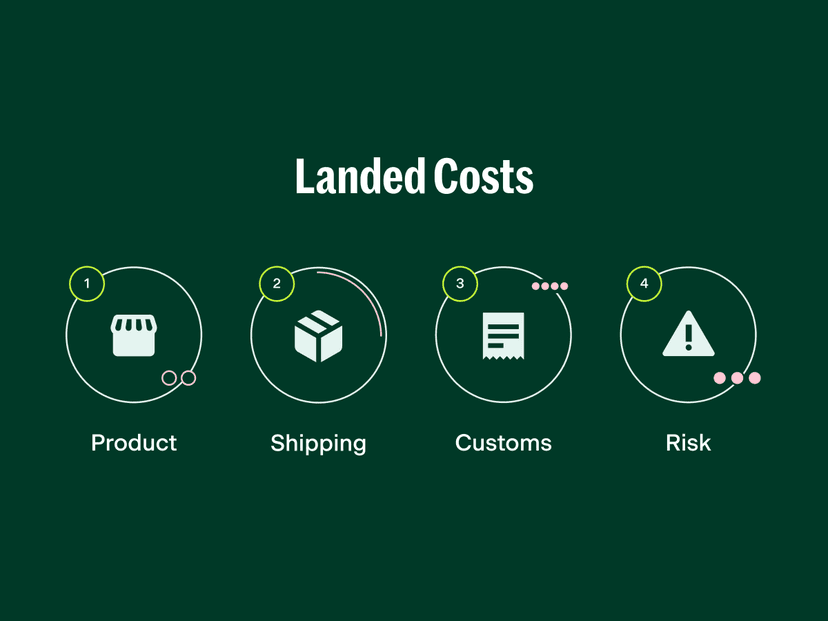

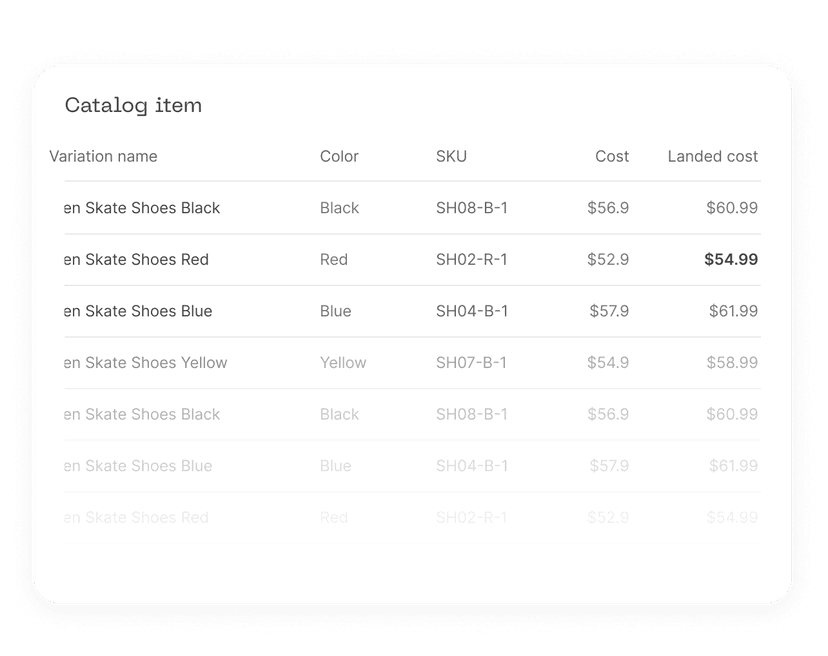

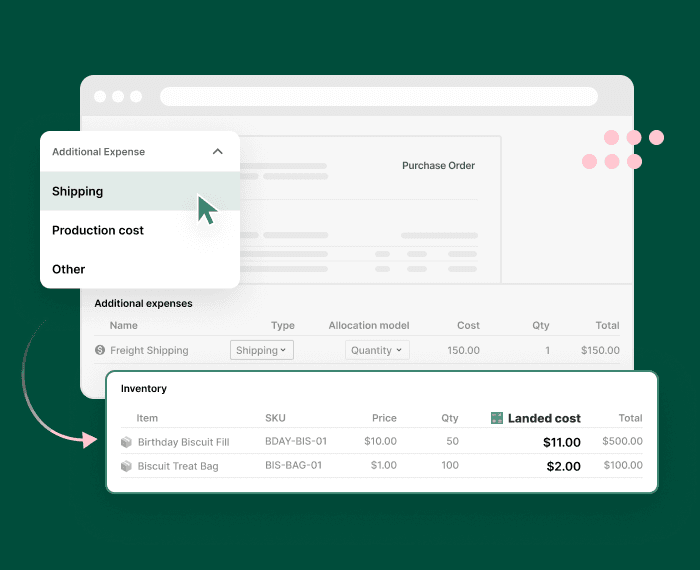

First AP solution with real-time, accurate landed costs for every SKU

The first AP solution with real-time, accurate landed costs calculations

Learn6 min read

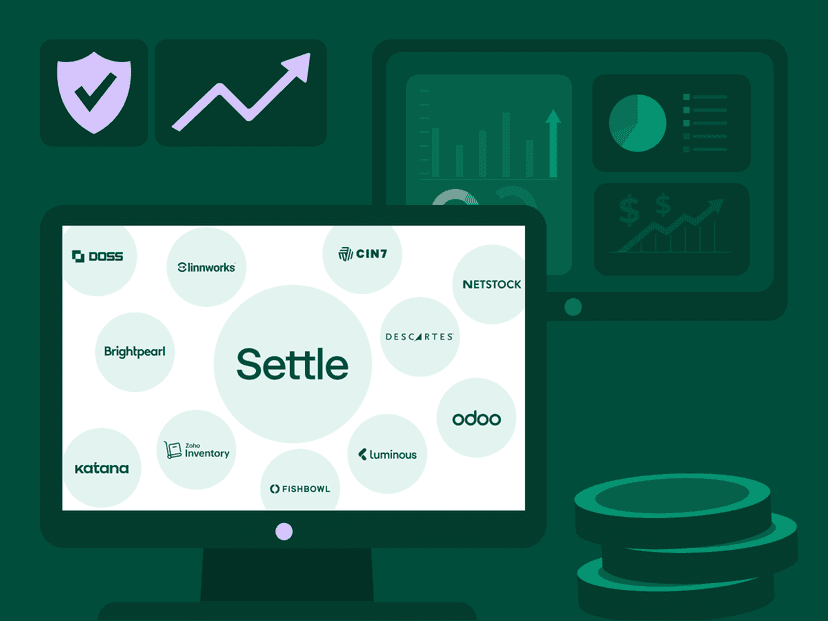

From Procurement to Delivery: The Power of the Modern Ops Stack in E-commerce

Behind this eCommerce surge lies a complex infrastructure of tools and services—known as the Modern Operations Stack—that helps CPG brands manage their day-to-day operations.

New Feature3 min read

Settle 2023 Product Wrap

A year in review of Settle's product releases that make running CPG brands easier.

Learn6 min read

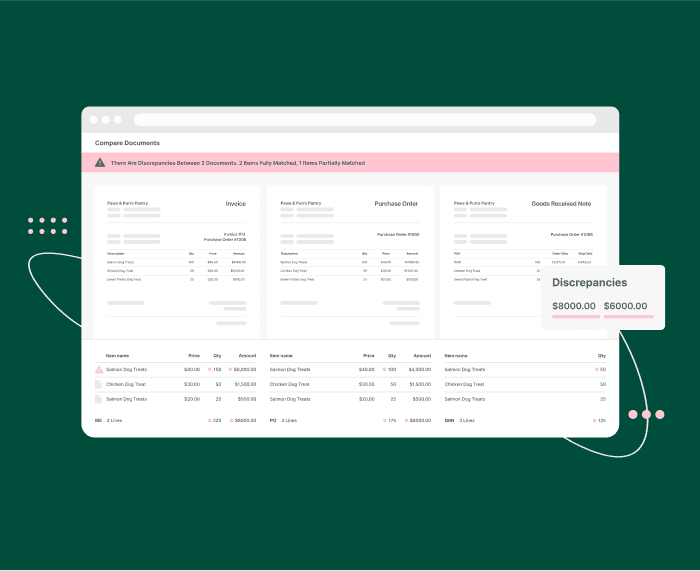

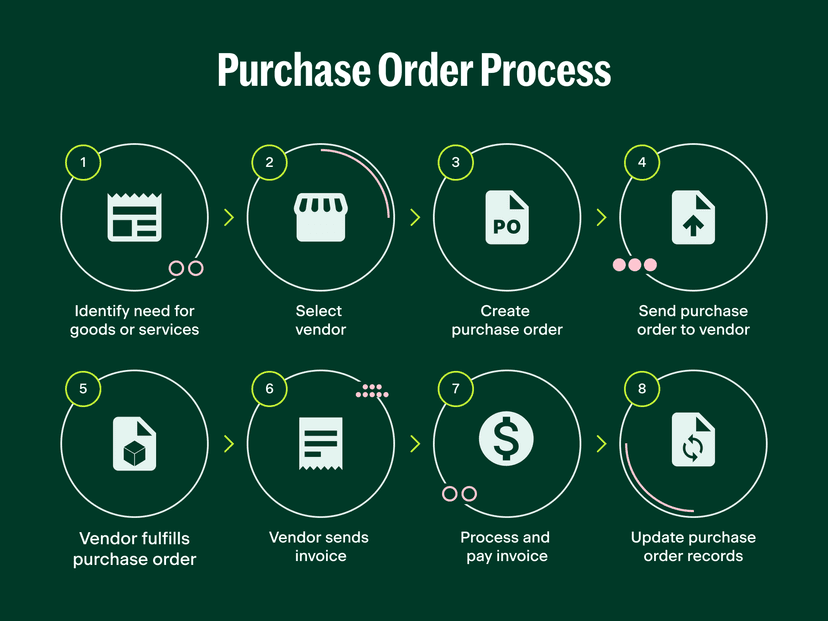

Streamlining Inventory Purchasing: 3-Way Purchase Order Matching 101

Learn the process of verifying your PO, GRN, and invoice to ensure precise vendor payments.

Learn3 min read

5 Reasons to Choose Debt Financing Over Equity Financing for Your Business

Debt financing allows businesses to maintain full ownership while providing predictable repayment terms, tax advantages, and improved creditworthiness, making it a strategic choice for growth.

Learn4 min read

5 Smart Cash Flow Moves to Make After Landing a Big Order

Securing a big retail order is a game-changer for any CPG brand, but growth brings complexity. Managing wholesale, retail partnerships, and supplier payments while keeping cash flow healthy requires the right financial strategies.

Learn6 min read

An Introduction to Cash Flow Forecasting

A company's ability to make a cash flow forecast is essential in the world of modern business. Here is everything you need to know about cash flow forecasting.

New Feature3 min read

A2X and Settle: Revolutionizing Ecommerce Accounting

Ecommerce businesses face growing challenges when it comes to accurate financial reporting. Many struggle to reconcile payouts from multiple sales channels and calculate true landed costs for their inventory. In this webinar, A2X and Settle walk through a smarter workflow that brings these pieces together, helping brands get accurate COGS, cleaner books, and better financial visibility.

Learn4 min read

Accurate Accounts Payable Forecasting and Budgeting: A Strategic Guide

Learn how accurate AP forecasting and budgeting can improve cash flow management, optimize spending, and strengthen vendor relationships with our strategic guide.

New Feature4 min read

April Product Updates: Partial Payments, Vendor Reports, and 10 More Ways to Streamline Your Workflow

This month's Settle release includes 11 updates built to reduce manual work and give teams more control — including partial external payments, downloadable vendor reports, FX support, and mid-month inventory reporting.

Learn4 min read

The Invoice: Free Access to Landed Cost Tracking + 7 New Features

This month, we're expanding access to two powerful features—automated bill pay and landed cost tracking—by including them in our $0/month Launch Plan. Plus, we're introducing 7 new product updates across inventory, reporting, and vendor workflows.

Learn5 min read

How to Balance Inventory and Cash: Lessons for Food CPG Founders

Managing inventory as a food CPG founder isn't just about stocking shelves, it's about cash flow. Learn how to forecast demand, balance stock levels, and optimize purchasing to keep your business running efficiently.

Learn6 min read

Black Friday CPG Prep Checklist

Black Friday sets the tone for your business' holiday season. Start early on forecasting demand, devising marketing strategies, and preparing your site.

Learn4 min read

Settle x Rainbow CFO: Building a Finance Team for Each Stage of Growth

Learn how to build a finance team tailored to your growth stage with insights from Rainbow CFO. Discover key roles, milestones, and tips for maximizing finance relationships.

Learn5 min read

How to Find a CPG Distribution Partner

Partnering with the right distributor is arguably one of the most essential tasks for a retail company. Find out what to look for in distribution partners and how to source them.

Learn4 min read

Ditch Spreadsheets and Scale Your CPG Brand Faster

Still running your inventory business on spreadsheets? As your business scales, manual financial tracking creates costly errors and bottlenecks. Discover the key signs it's time to upgrade and how automation can streamline operations, improve cash flow, and fuel growth.

Learn4 min read

Do I Need an ERP to Manage My Supply Chain?

Effectively managing a supply chain is essential for any consumer brand working with a network of suppliers, distributors, and partners. If you're considering an ERP for your business, here are some key factors to evaluate to ensure it meets your supply chain needs.

Learn2 min read

Settle's Capital Partnerships Team Shares Do's and Don'ts After Summer Fancy Foods

Including sales tips and some of their favorite brands

Learn7 min read

A Comprehensive Look at Purchase Orders: What You Need to Know

It doesn't matter how big a company is: Purchase orders can help streamline many processes and keep things traceable and organized.

Learn11 min read

Find the Right Third-Party Logistics Partner for Your Business

Discover 10 leading 3PL providers and learn how the right partner can cut costs, speed up shipping, and help your ecommerce brand scale.

Learn5 min read

From Clicks to Shelves: Why Getting Into Retail is So Challenging

Moving from direct-to-consumer to retail distribution is a major leap that requires careful planning, financial precision, and a willingness to tackle new challenges head-on. Whether you're preparing to scale into broader retail or just getting your first taste of the shelf life, this is your chance to get noticed—without the usual barriers.

New Feature2 min read

From Order to Invoice: How to Streamline Your B2B Order-to-Cash Flow

Stop retyping orders, chasing invoices, and losing cash—here's how to automate your B2B workflow from start to finish

Learn4 min read

From PO to Payment: What is the Full SKU Lifecycle?

Discover the full SKU lifecycle—from purchase order to payment—and how Settle helps inventory brands automate operations and improve cash flow visibility.

Learn2 min read

Guide: The ABCs of cashflow

We put our heads together with the folks at IndieCPG to create a guide to the basics of cashflow for new (and maybe even not-so-new) founders.

Learn5 min read

Guide to Accounting and Fractional CFO Firms for eCommerce and CPG Brands

We've put together a comprehensive list of accountants and fractional CFOs who specialize in eCommerce and CPG businesses and have the experience and expertise to help your business succeed.

Learn2 min read

How CPG Brands Can Come Out of Prime Day Profitably

Prime Day is a major opportunity, but only if you're prepared. Learn how to use Settle to fund purchase orders, track true landed costs, and forecast demand with confidence.

Learn4 min read

Marketing on a Budget: How CPG Startups Can Test Paid Advertising

Discover how CPG startups can navigate paid advertising on a budget. Learn pricing strategies, content tactics, and agency evaluation tips for marketing success.

Learn4 min read

How Supply Chain Operators Are Actually Using AI (Spoiler: It's Not What You Think)

AI isn't transforming supply chains with sci-fi magic—it's quietly killing the mind-numbing chores that soak up operators' days. From auto-cleaning messy data to drafting docs and surfacing real-time forecasts, teams are letting an "intern that never sleeps" handle the grunt work so people can focus on decisions that actually move the business.

Learn7 min read

How To Audit Your PO Process: Tips to Save Time

Discover how auditing your purchase order process can lead to improved efficiency and accuracy in your supply chain.

Learn5 min read

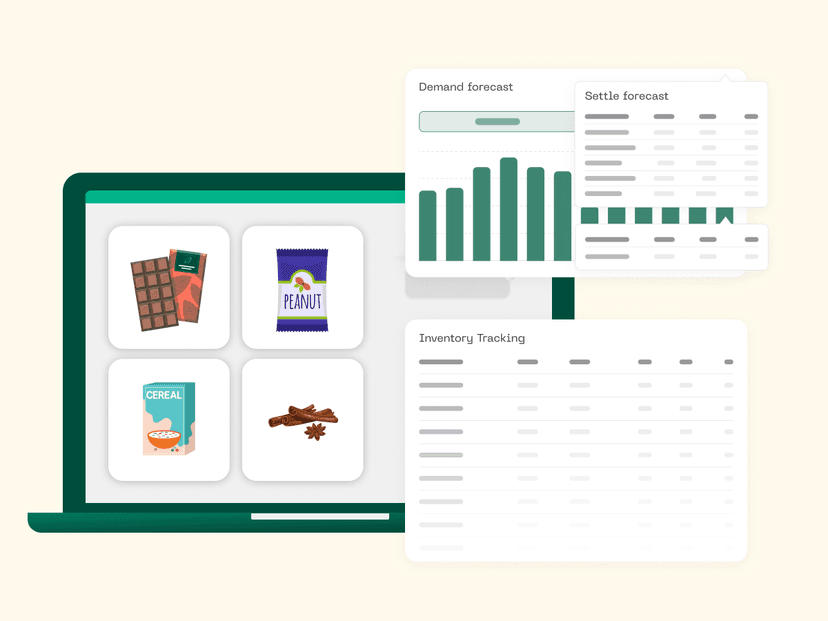

How to Choose the Best Inventory Management System for Small and Emerging eCommerce and CPG Brands in the U.S.

The right inventory management system does more than track stock — it automates COGS, streamlines fulfillment, and fuels growth. In this guide, we show small and emerging U.S. ecommerce and CPG brands how to choose the best IMS to save time, cut costs, and scale confidently.

Learn7 min read

How to Evaluate Accounting Firms

Figuring how to find the right accounting firm for your company can be difficult. Here's how to choose the best accounting firm for any business.

Learn17 min read

Understanding Inventory Turnover: Essential Tips for eCommerce & CPG Brands

Running an ecommerce or CPG brand today requires careful inventory management to keep cash flowing and operations smooth. Tracking inventory turnover doesn’t just prevent stockouts — it frees up working capital, reduces waste, and enables smarter growth decisions. In this guide, we explain why turnover matters and how to use it to scale efficiently.

Learn5 min read

The Margin Conversation Accountants Should Start in September

Why inventory-led brands need COGS clarity, cash flow planning, and working capital strategy now for a stronger 2026.

Learn14 min read

Settle Spotlight Series: Q&A with SourceMedium

In this month’s Settle Spotlight Series, we chatted with Will Holtz from SourceMedium about how interconnected data can be a superpower for brands in hyperscale mode.

Learn4 min read

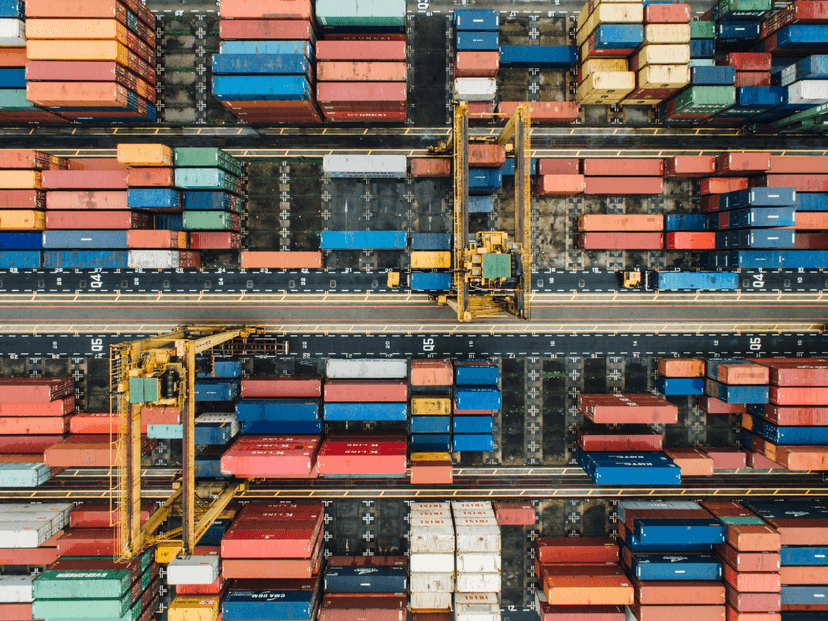

Why Supply Chain Visibility Matters and How to Achieve It

Improving supply chain visibility is becoming a priority for many companies, as it’s essential for streamlining operations, boosting efficiency, and maintaining strong customer satisfaction for consumer brands.

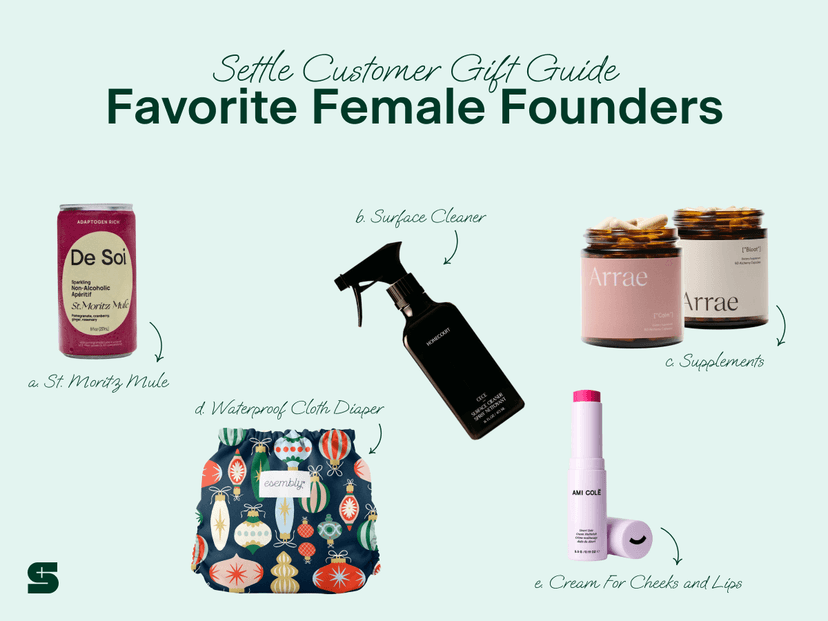

Learn1 min read

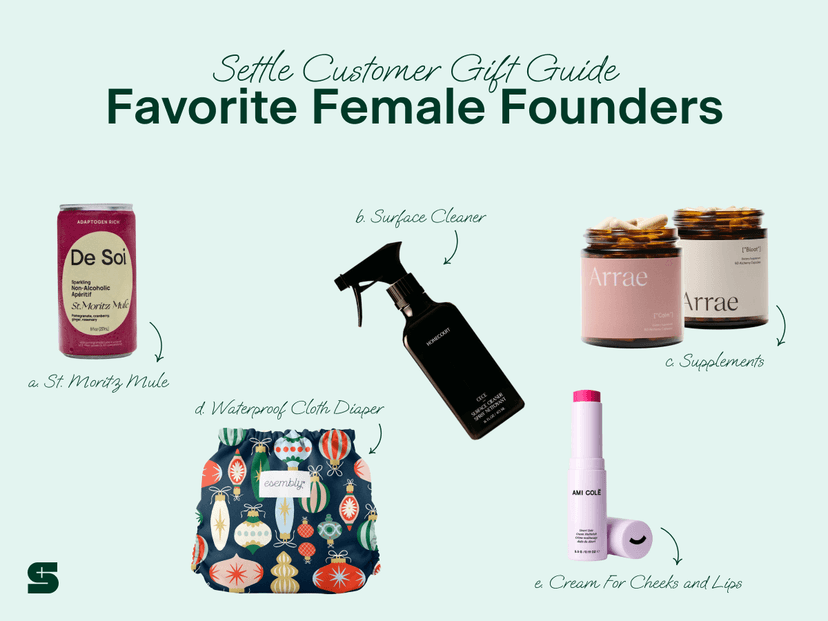

Settle Staff Picks Holiday Gift Guide 2024: Female Founders

Looking for thoughtful gifts that from incredible female-founded brands? Here are our picks.

Learn3 min read

What is Purchase Order Line Item Matching?

Learn what line item matching is and how it enhances AP processes.

New Feature6 min read

Stop Playing Vendor Telephone: How to Build Real Supply Chain Partnerships

Supply‑chain success isn’t about perfect vendors—it’s about shared visibility. When you and your suppliers see the same milestone timeline, delays turn into proactive conversations instead of last‑minute surprises, freight costs stay predictable, and trust deepens on both sides.

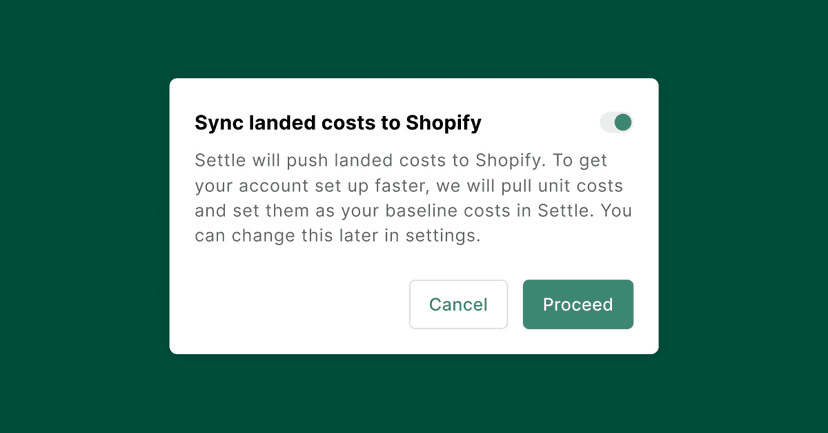

New Feature3 min read

Shopify Sellers, Meet Your New Favorite Finance Tool: Settle

Shopify sellers, say goodbye to inventory guesswork and manual spreadsheets! Settle is now live in the Shopify App Store, helping you automate real-time inventory tracking, sync sales data, and simplify cost calculations—all in one place

New Feature2 min read

The InVoice : True Profit Visibility for every SKU & 5 More Time-Savers

June is all about cleaner margins and fewer manual tweaks. From landed-cost syncs that keep Shopify profit numbers honest to smarter PO payment schedules, these six updates are built to save you clicks and improve accuracy.

Learn4 min read

Settle x DTC Experts: The Power of Alternative Financing

Discover insights from the Settle x DTC Experts panel on alternative financing, cash flow management, and profitability strategies from the founders of HigherDose and Mockingbird.

Learn3 min read

Settle's Head of Revenue Shares Top Trends from Expo West 2025

The Settle team always looks forward to Expo West as an opportunity to connect with incredible CPG brands and industry partners, and this year was truly special. Our Head of Revenue, Christopher Dittmer, shares his thoughts on the evolving landscape of Expo West and the key trends that stood out in 2025.

Company News3 min read

Settle and Dwight Funding Announce Partnership for Hypergrowth Consumer Brands

The accounts payable startup and modern working capital partner will team up to fund brands from inventory build through sales

Learn3 min read

Supply Chain Risks: Lessons from the Suez Canal Crisis and Preparing for the Holiday Season

Learn how the Suez Canal crisis exposed supply chain vulnerabilities and discover essential strategies to prepare for the holiday season.

Learn9 min read

Understanding Financial Challenges in eCommerce: A Comprehensive Guide

A comprehensive guide to understanding the financial challenges in eCommerce.

Learn2 min read

The 2024 Settle Staff Picks Holiday Gift Guide

Do you really need another gift guide this time of year? Our Settle team spends so much time obsessing over our customer brands, that the right answer is obviously yes. We have compiled the inaugural Settle Staff Picks Holiday Gift Guide, with the most fire small brands out there. So read on for ideas from stocking stuffers to travel accessories – for everyone on your list. And join us in shopping small this holiday.

New Feature1 min read

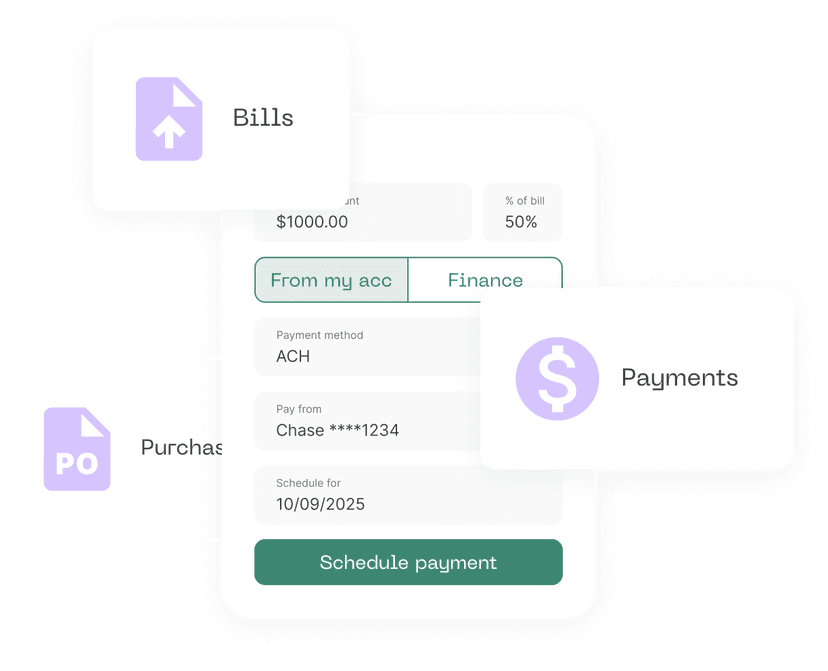

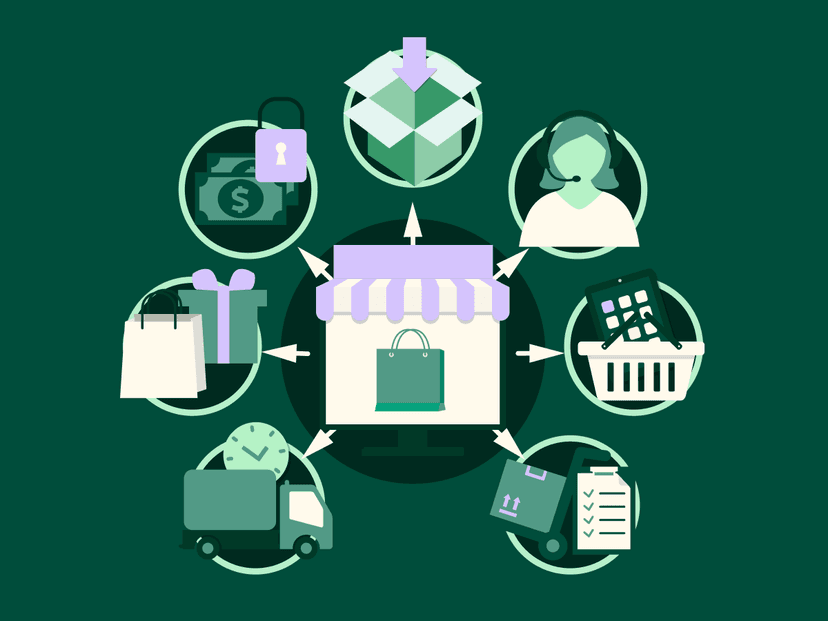

Your purchasing process. Made simple.

We brought simplicity to bill pay. Now we’re bringing it to the purchasing process, with end-to-end support that takes a load off your plate.

Learn3 min read

Understanding Landed Costs for CPG and DTC Companies

Learn why understanding landed costs is vital for better financial decisions, improved profit margins, and staying competitive.

Learn3 min read

Nailing retail distribution: 5 Tips for summer-focused brands

5 Tips on where to meet retail buyers and lockdown partnerships

Learn3 min read

The CPG Guide to Managing Tariff Uncertainty

Proper planning is key to protecting profit in times of tariff uncertainty. With potential plans to impose a 60% tariff on Chinese goods and a 10% to 20% tariff on other imported goods, many CPG brands are taking 4 key steps now so they don’t get a shock to their COGs.

Learn5 min read

Settle x DTC Experts: Beyond Conventional Funding - Alternative Paths for DTC Brands

Discover how Pattern Brands and Flakes used alternative funding strategies to scale their e-commerce brands profitably.

Learn5 min read

‘Tis the Season: 7 Tips to Manage Black Friday Inventory

Managing seasonal product demands can be a struggle for many companies. This is how businesses can make the most out of seasonal campaigns and sales.

Learn1 min read

Settle Staff Picks Holiday Gift Guide 2024: Hosting

f you’re shopping for the perfect host, we’ve curated entertaining essentials from our incredible Settle customers.

Company News3 min read

Settle and Cin7 Partner Introduce First Embedded Vendor Payment Solution for CPG brands

Announcing our new partnership with Cin7 to introduce the first Pay with Settle button for Cin7 Core users.

Learn4 min read

Rethinking Production to Prepare for Tariff Volatility

Rising tariffs are disrupting supply chains, forcing CPG brands to rethink production and financing strategies. Learn how reshoring, supplier diversification, and alternative funding options can help brands navigate trade uncertainty and stay competitive.

Company News2 min read

Settle books $145M credit facility from Silicon Valley Bank

Settle secures up to $145 million in a new credit facility from Silicon Valley Bank

Learn20 min read

The 14 Best Working Capital Solutions for eCommerce Businesses in 2025

Running an eCommerce brand today is capital-intensive and fast-moving. The right working capital solution doesn’t just fund your next purchase order — it keeps cash flowing, marketing running, and growth on track without giving up equity. In this guide, we break down the 14 best working capital solutions for eCommerce businesses in 2025.

Learn2 min read

Settle's Head of Revenue Recaps His Top Do's and Don'ts After Expo West

What he saw, loved and learned from the "super bowl" of CPG events.

Learn5 min read

Beyond TikTok: How CPG brands are diversifying their marketing strategy

The CPG landscape is no stranger to major shifts, but with discussions of a potential TikTok ban in the U.S., brands are facing a moment of reckoning. For brands that built their growth strategy around TikTok’s algorithm – this uncertainty is a wakeup call.

Learn4 min read

The Smartest Q4 Move Inventory Brands Can Make Now

Q4 will be here before you know it. Discover how proactive brands are using working capital now to secure inventory, boost margins, and avoid year-end chaos.

New Feature3 min read

The InVoice : 11 New Ways to Boost Setup & Inventory Management

We’ve launched 11 new updates to help you move faster—from tagging SKUs in bulk to attaching docs to sales orders. Whether you're cleaning up your catalog or keeping vendors in the loop, there's something here to make your back office smoother and more organized.

Learn5 min read

The Purchase Order Journey: What are the steps of a PO?

Discover the steps of a purchase order journey from identifying needs to invoice processing.

New Feature2 min read

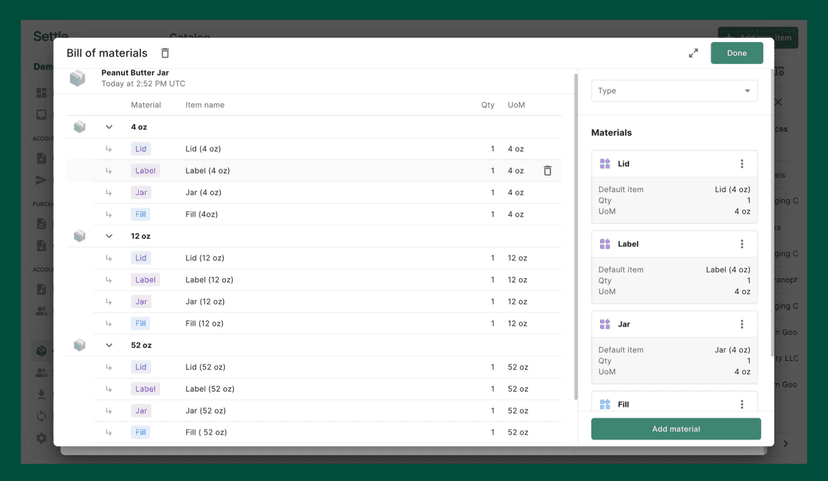

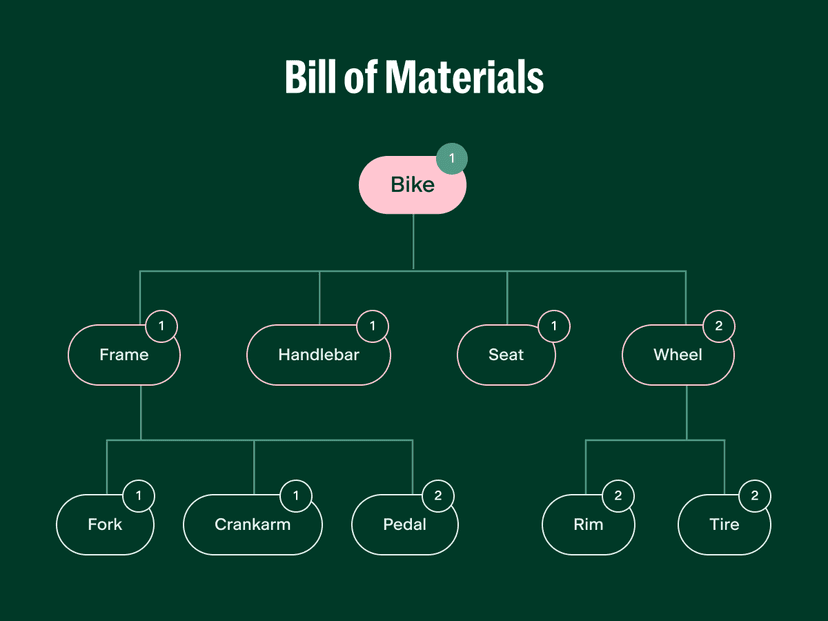

Introducing the Universal Catalog: your single source of truth from raw material to finished goods

Connect your supply chain, operations, purchasing, and accounting workflows into a single platform

Company News3 min read

Series B Raise

Settle raises their Series B

Learn4 min read

What is inventory planning? How should summer focused brands inventory plan for 2023 amidst a recession?

A quick breakdown of inventory planning and different factors that should be considered when planning.

Learn4 min read

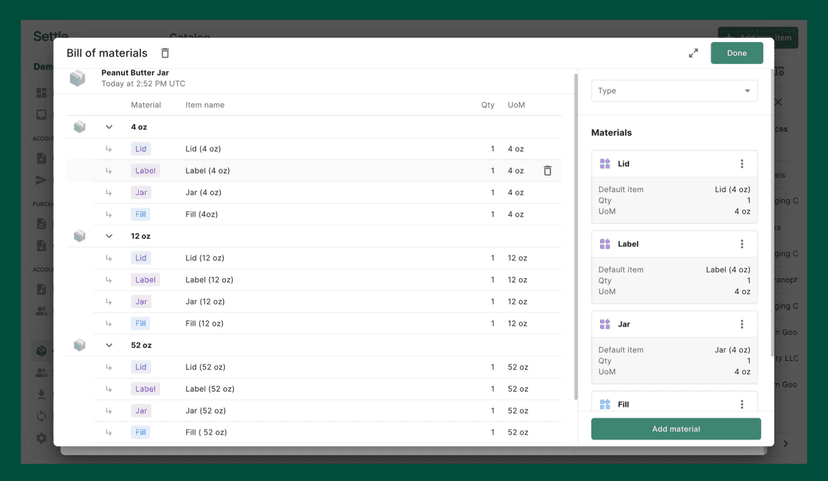

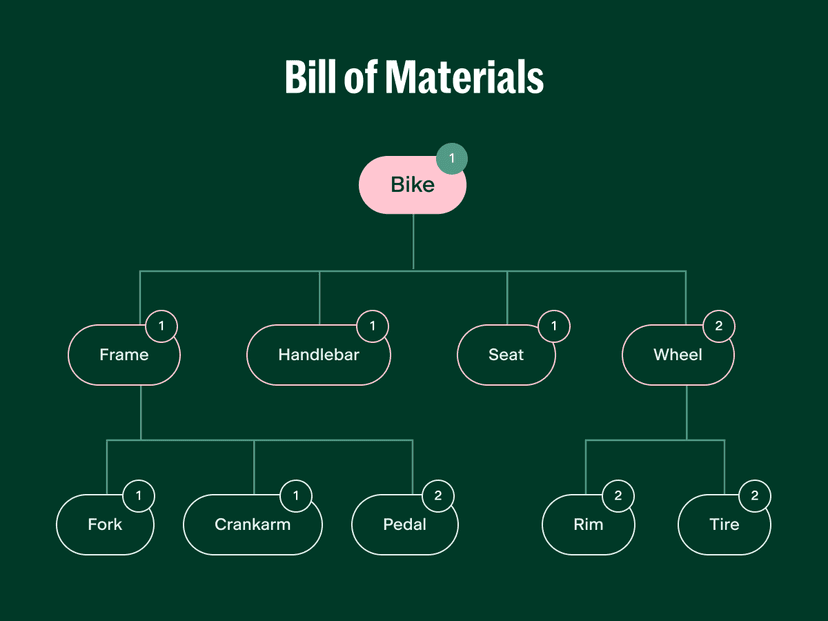

Understanding Bills of Materials (BOMs) and Their Benefits for CPG and E-commerce Businesses

Dive into what are BOMs and how they drive efficiency, accuracy, and scalability.

Learn2 min read

Settle Staff Picks Holiday Gift Guide 2024: Little Luxuries

These indulgent picks are all about treating yourself to the ultimate in beauty, comfort, and style—because you deserve it this holiday season!

Learn1 min read

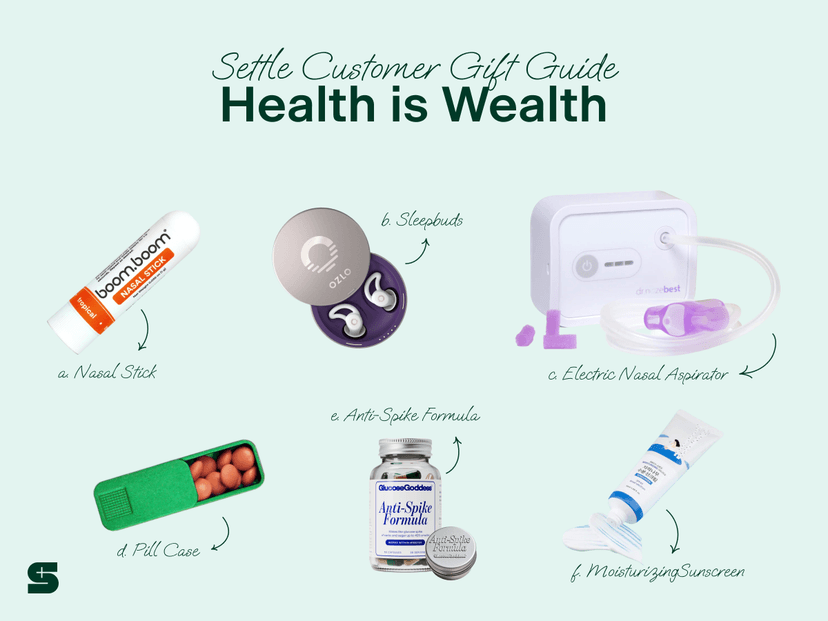

Settle Staff Picks Holiday Gift Guide 2024: Wellness

If you’re gifting at the last minute, we’ve curated ideas from the most intentional brands—our Settle customer products. Get a head start on 2025 with our picks for self-care.

Learn3 min read

Second in Command Podcast with Settle's COO, Olivia Micallef

In this episode of the Second in Command podcast, Olivia Micallef, the COO of Settle, talks about how Settle helps consumer scale by optimizing cash flow and her journey from a large company to a small company.

Learn16 min read

The 12 Best Ecommerce Inventory Management Software Solutions for 2025

Running an online store is fast-paced, competitive, and unforgiving. The right inventory management software doesn’t just keep track of stock, it calculates your margins, improves fulfillment, and gives you the insights to grow without guesswork. In this guide, we break down the 12 best ecommerce inventory management software solutions for 2025.

Learn8 min read

Navigating Distribution And Retail Margins for CPG Brands

For emerging CPG brands, navigating challenges like supply chain disruptions and retail changes underscores the critical importance of understanding and managing retailer and distributor margins, as it directly impacts profitability and success in the industry.

Learn3 min read

The Hidden Costs of Ecommerce Accounting, and How to Eliminate Them

Ecommerce brands are built on speed, but accounting is often left in the dust. When revenue, fees, inventory purchases, and vendor payments all live in disconnected systems, financial blind spots emerge. And those hidden costs, the time spent reconciling, the errors, the missed margins, slowly chip away at growth. The good news? Modern tools like A2X are helping brands close the gap, giving founders back their margins (and their sanity).

New Feature7 min read

The New Settle: Scale your CPG brand faster and more profitably

Settle is now your unified solution for best in class procurement, inventory, AP, and financing.

Learn4 min read

Optimize Vendor Relationships with AP Automation

Discover how Settle’s Accounts Payable (AP) automation fosters robust vendor relationships for inventory-led success.

Learn5 min read

We Get It. Your Business is Your Life. Let's Navigate This Together.

Running a CPG brand is deeply personal—and in uncertain times, every dollar counts. With a 90-day tariff reprieve in effect, now’s the moment to regroup and reclaim margin. In this post, we explore how to use landed cost tracking and cost allocation models to make smarter purchasing decisions, plus how Settle’s tools can help founders price confidently, cut operational waste, and protect what matters most.

Learn2 min read

The Settle Team Shares Highlights from Newtopia

Including new ways brands are marketing themselves and their favorite brands from the show

Company News3 min read

Settle Launches Purchase Order Automatic 3-Way Matching, Revolutionizing Procurement Processes

First platform for inventory businesses to natively order, receive, match, and pay to ensure accuracy and efficiency for CPG brands

Company News2 min read

Settle Launches First Accounts Payable Solution to Automate Landed Costs for CPG Brands

The new offerings streamline and automate manual tasks, empowering brands to reduce errors, save time, and focus on growth.

Learn4 min read

Ready to Scale? Read This Before You Borrow

Hidden fees, strict repayment terms, and misleading APRs can hurt more than help. Before committing to funding for your CPG or ecommerce brand, know the difference between your capital options.

Learn3 min read

Navigating the New Year: A Cash Flow Guide for CPG Brands

Navigate the dawn of a new year with insights on cash flow management, as we unveil strategies to empower CPG brands for the challenges and opportunities that lie ahead.

Company News3 min read

Settle acquires Turbine to bring the best of inventory management and costing to more CPG Brands

Settle has acquired Turbine, a company that shares Settle’s mission to help brands solve their toughest operational challenges. This acquisition marks a significant milestone for Settle as we expand our capabilities to better serve consumer brands looking to scale with efficiency and precision.