The purchase order (PO) process is one of an effective supply chain's most important yet often overlooked components.

Good purchase order management is crucial for saving valuable time, money, and other resources while moving goods from production to your warehouse. More importantly, it prevents stockouts and frustrated customers, which can ultimately hurt your bottom line. In addition, the same processes or workflows for purchase order tracking that once worked for your brand when you first started will not necessarily work well as you continue to grow and scale. Therefore, it's crucial to revise your purchase order process regularly and identify areas for improvement.

Auditing your current PO procedures can reveal critical bottlenecks, uncover opportunities to strengthen supplier relationships, highlight new ways to optimize payment terms and, most importantly, unveil new opportunities for technology and automation to replace outdated, manual processes that prevent you from operating efficiently and effectively. So, where should you start? Here are a few key tips for auditing your PO process to save time and money—from pre-production through final delivery to your warehouse.

Identify bottlenecks in your PO workflow

Bottlenecks in a purchase order (PO) workflow can lead to delays, inefficiencies, and increased costs. To avoid these issues, it's crucial to identify and eliminate these bottlenecks in the PO process.

Start by thoroughly analyzing your existing supply chain data to uncover trends or patterns that may be contributing to bottlenecks.

For example, you can look at the time it takes to finalize POs, the volume of POs processed daily, or the number of late orders or shipments.

You can also perform a root cause analysis to determine the fundamental reasons behind bottlenecks.

This involves a comprehensive examination of the processes and systems within the purchase order workflow, which may reveal issues such as poor communication between departments, insufficient resources, or outdated technology.

Once you identify these bottlenecks, prioritize them based on their potential impact on the business and how easily you can address them. Some bottlenecks may have a more significant impact on operations or customer satisfaction, while others may be easier to resolve.

Focusing on the most critical bottlenecks first can help you achieve quick wins and maximize your time and resources.You should also look at supplier-specific bottlenecks. For example, consistently tardy deliveries or unresponsiveness to inquiries from certain suppliers can significantly impede your PO process.

Evaluate how you communicate with suppliers and, if needed, establish more stringent performance criteria for them.

We'll discuss the importance of evaluating supplier performance in the next section, but miscommunication with suppliers is often one of the biggest reasons behind delays, especially when relying on outdated tools like emails, spreadsheets, or back-and-forth phone calls to check in on order status.

Evaluate supplier performance

The strength of your relationships with suppliers significantly influences the effectiveness of your supply chain.

Reliable suppliers are essential for maintaining a steady flow of goods, which helps ensure that you meet production timelines, minimize disruptions, and ultimately keep customers happy so that they continue to purchase from you.

Therefore, it is critical to evaluate, track, and improve your suppliers' performance and have open discussions with them about performance.

Supplier scorecards, for example, are an effective method for assessing and comparing supplier performance.

These scorecards can help you quickly identify your best and worst suppliers when it comes to getting products out on time and make smarter decisions about which suppliers to continue working with or which suppliers you may need to revisit or replace.

You can then use these scorecards as an easy jumping-off point for more transparent and open discussions with suppliers, which ultimately builds trust and strengthens your supplier relationships overall. Strong supplier relationships are crucial for effectively mitigating risks. Other factors to consider when evaluating supplier performance include financial stability, production capabilities, quality control processes, sustainability practices, and metrics like supplier engagement rate and on-time delivery.

Selecting suppliers that meet your standards and values can ensure a reliable supply chain and improve your business's overall performance.

Additional factors to consider when evaluating suppliers include financial stability, production capabilities, quality control processes, and sustainability practices.

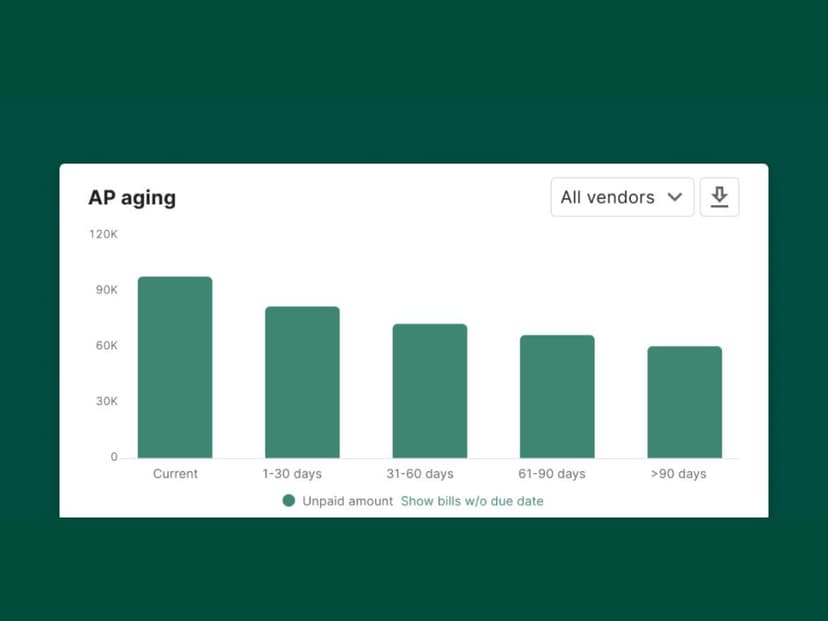

Revise and optimize your payment terms

Payment doesn't have to slow down your purchase order process.

Discuss payment schedules, discounts, and early payment incentives with suppliers. Negotiating favorable terms allows you to optimize payment dates to better fit your unique supply chain process and better account for unexpected disruptions.

Most importantly, you can free up cash and allocate resources more effectively to other areas of the supply chain.

One strategic approach to optimizing payment terms is negotiating extended terms with suppliers. This allows more time to settle invoices without incurring penalties or interest.

Another strategy to optimize payment terms is to capitalize on early payment discounts, ranging from 1-5% for payments made within a specified time frame, such as 10 or 30 days.

Taking advantage of these discounts can lead to substantial cost savings and give you more payment flexibility.

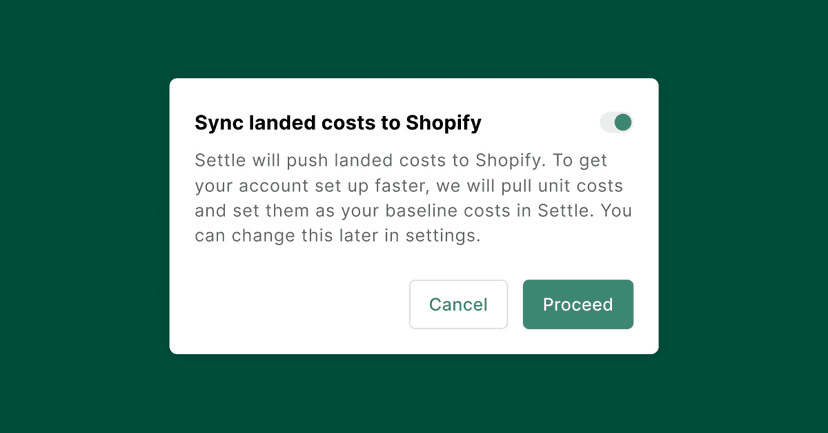

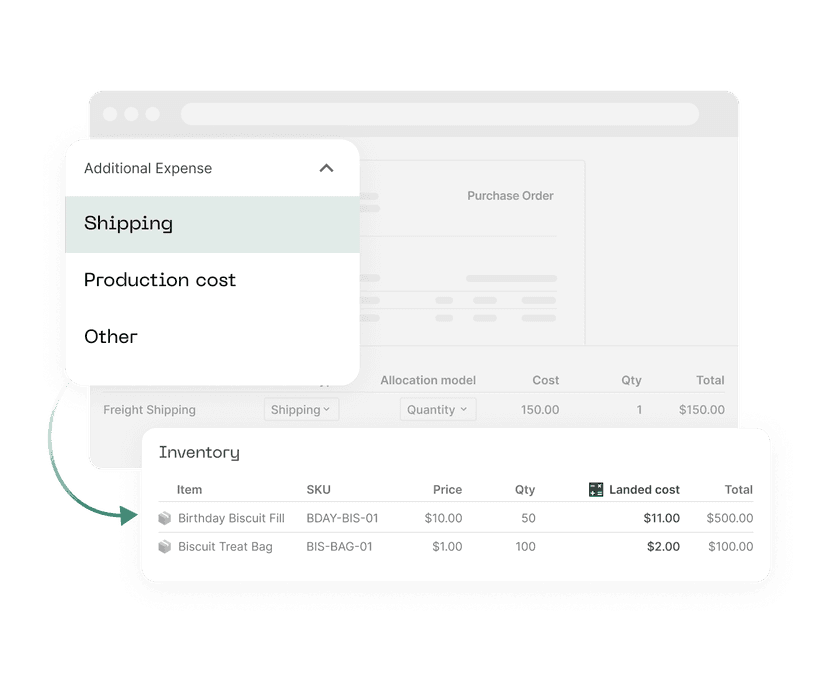

Additionally, you can evaluate if supply chain financing makes sense for your brand.

This form of financing lets you borrow funds from a financial institution to settle supplier invoices, extending payment terms without direct negotiations with suppliers. Settle, for example, offers transparent terms, holistic underwriting, and flexible repayment options for CPG brands that finance through us.

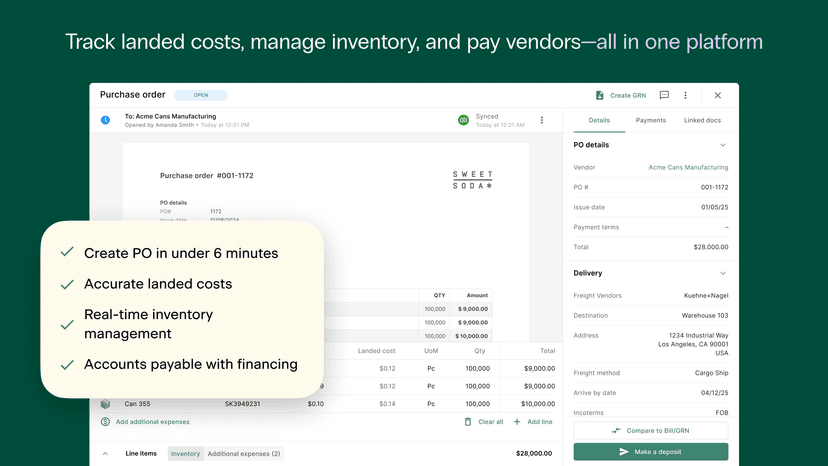

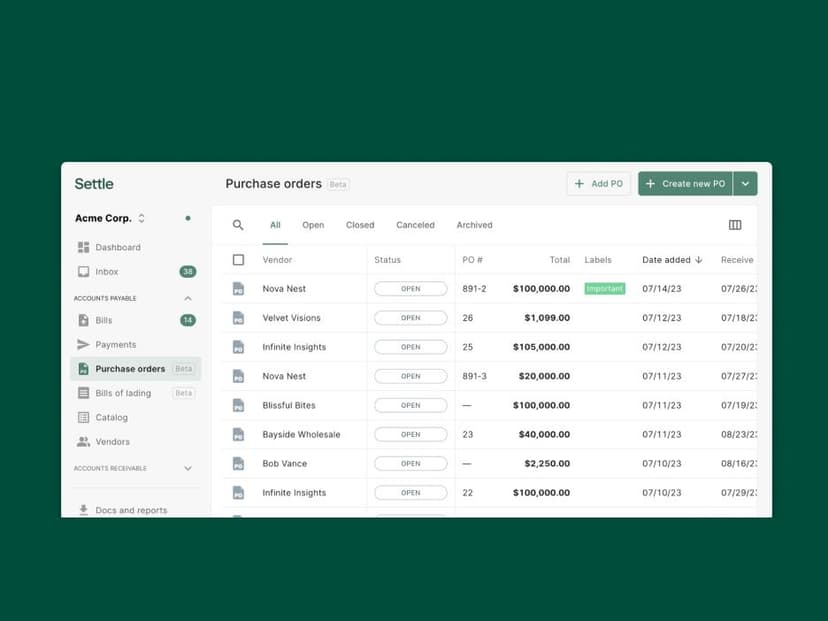

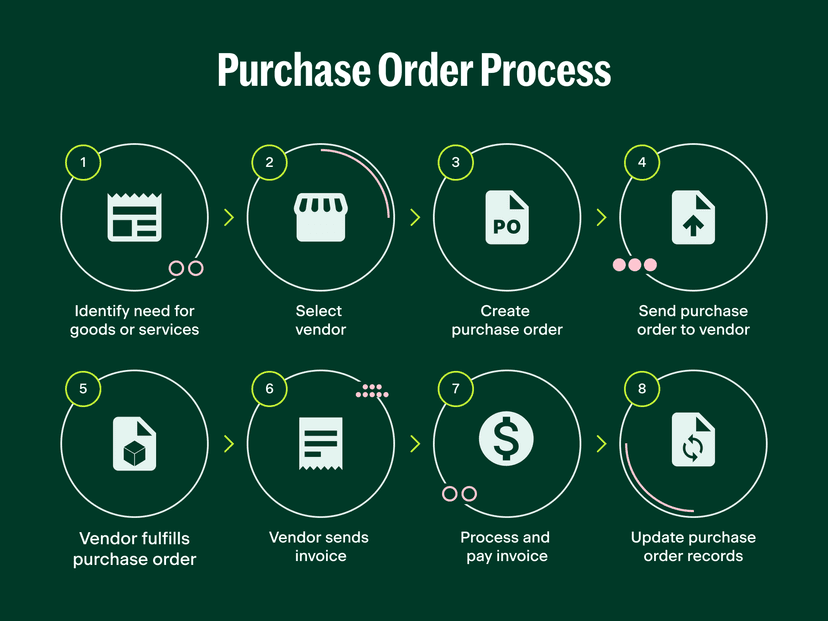

Automate your purchase order process

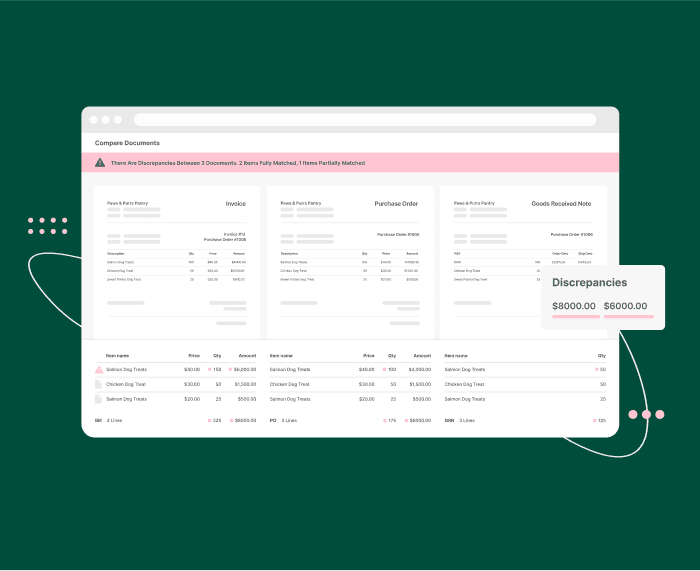

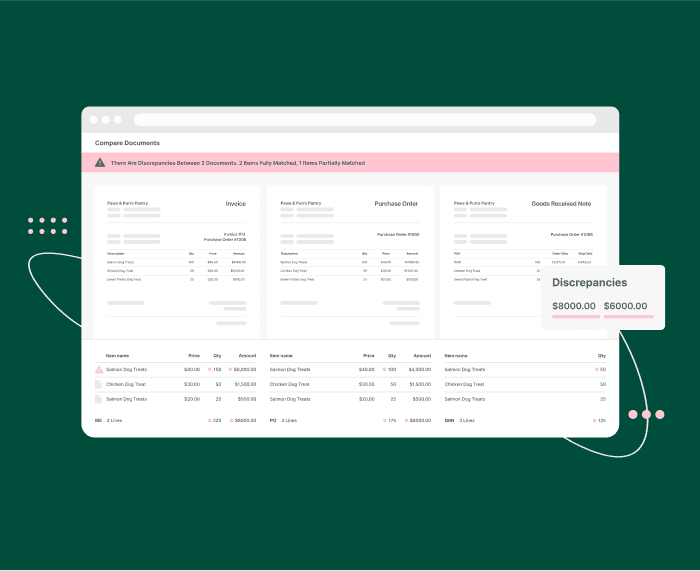

Automating your purchase order processes is the best way to streamline workflows, eliminate errors, and enhance overall accuracy and precision throughout your supply chain.

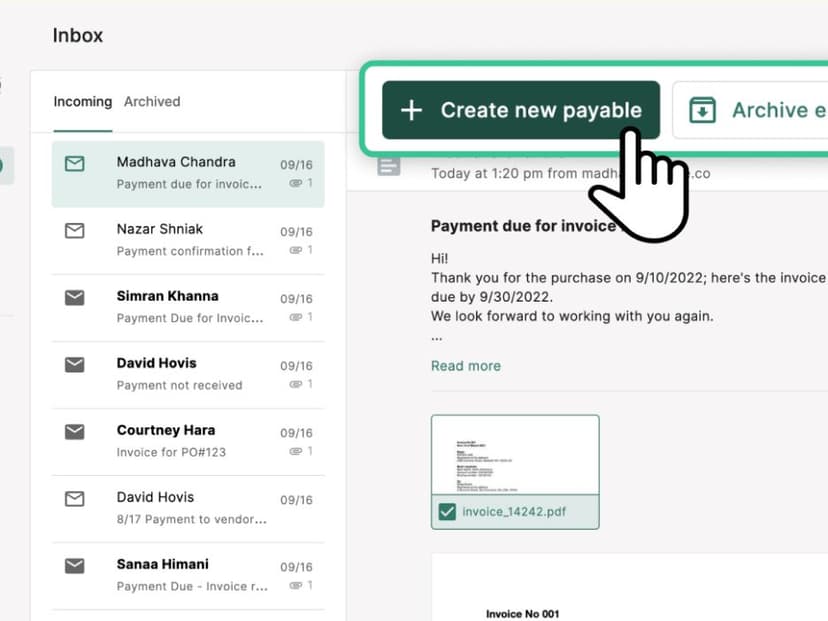

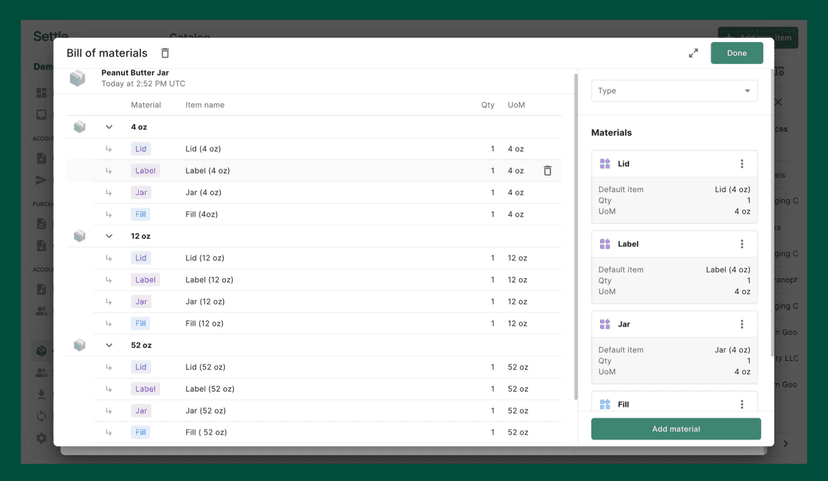

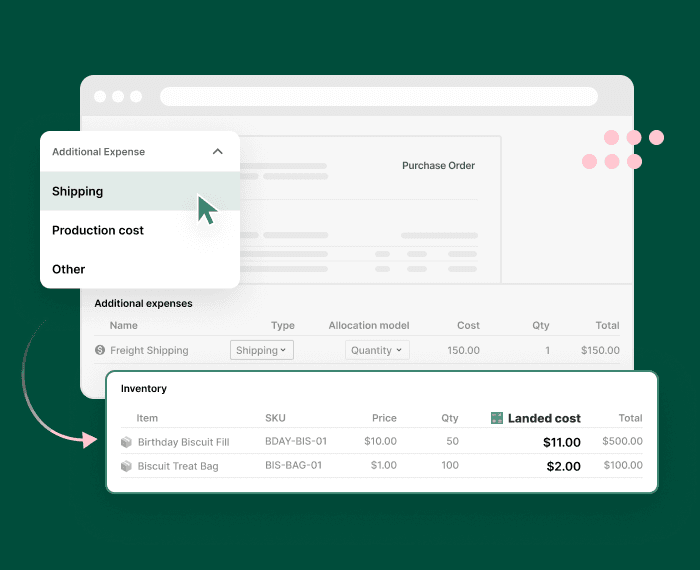

To achieve this, you can employ various supply chain management software solutions, including enterprise resource planning (ERP) systems, procurement software, and supply chain visibility platforms like Anvyl which include purchase order management tools. These systems can assist in supplier management, purchase order creation and tracking, approval automation, and more. Best-in-class solutions also integrate with your accounting system or other aspects of your supply chain tech stack, creating a single source of truth for your most crucial supply chain information and data.

Some of the additional benefits of automating your purchase order process include:

- Cost reduction: Minimize expenditures on manual tasks like data entry and order tracking, optimizing time and resources.

- Enhanced efficiency: Streamline workflows and eradicate bottlenecks, allowing your team to concentrate on high-impact tasks instead of tedious, manual tasks that waste precious time.

- Enhanced precision: Reduce errors associated with manual data entry, mitigate the risk of costly mistakes and ensure every order is processed correctly.

- Enhanced supplier relationships: Strengthen supplier relationships by providing visibility of real-time order status leading to stronger partnerships and more favorable terms and conditions.

If you're considering bringing on new technology to help automate your purchase order process, starting with an audit of your PO process will also help pinpoint the most critical problems you want new technology to solve within your supply chain and help you identify which features are most important to you as you evaluate your options.

Auditing and refining your purchase order process is not just a task—it's necessary to scale and maintain efficiency in your supply chain.

Regular audits and updates will help you eliminate inefficiencies, leverage new technologies, and strengthen partnerships critical to your business success.

By continuously improving your PO management, you can ensure smoother operations, satisfied customers, and a healthier bottom line.

About Anvyl

Anvyl connects global supply chain teams, systems, and suppliers to improve collaboration and decision-making from pre-PO issuance to warehouse delivery. This flexible tool facilitates real-time collaboration, automates critical tasks and processes, and empowers teams with deeper insights that allow them to make smarter decisions faster.

To learn more, visit www.anvyl.com.