The 14 Best Working Capital Solutions for eCommerce Businesses in 2025

Running an eCommerce business has never been more challenging or more capital-intensive. Between rising customer acquisition costs, longer supply chains, unpredictable tariffs and changing payment cycles, growth requires access to cash that’s fast, flexible, and transparent. That’s where working capital solutions come in.

The right working capital partner can help you fund inventory, pay for marketing, purchase packaging, smooth cash flow, and scale confidently without diluting equity or taking on unnecessary risk.

In this guide, we break down the 14 best working capital solutions for ecommerce businesses in 2025, from modern fintech lenders to traditional financing options. Each one is built to help you keep inventory flowing and your growth goals within reach.

What is Working Capital for eCommerce?

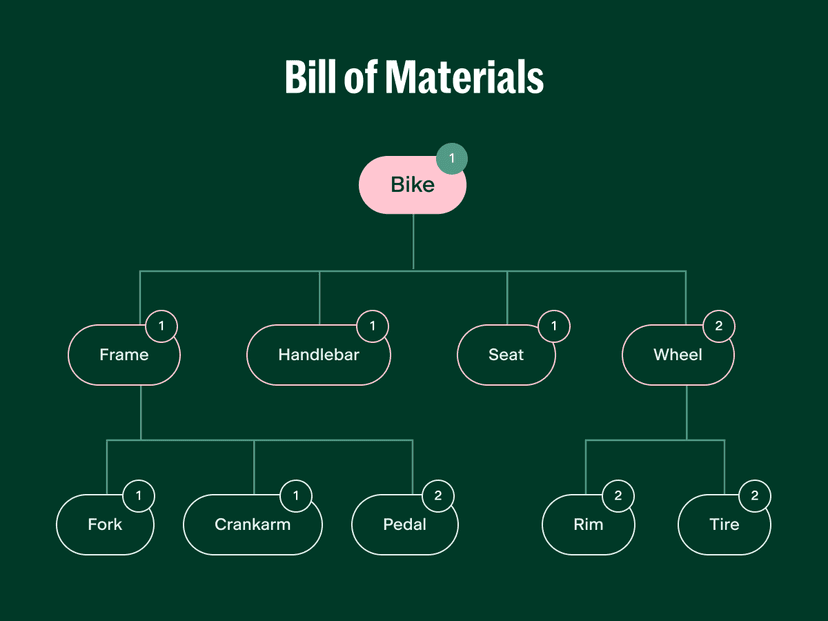

Working capital is the cash your business needs to keep daily operations running smoothly — buying inventory, paying suppliers, covering marketing costs, and staying agile during seasonal swings. It’s the short-term fuel that keeps your engine moving.

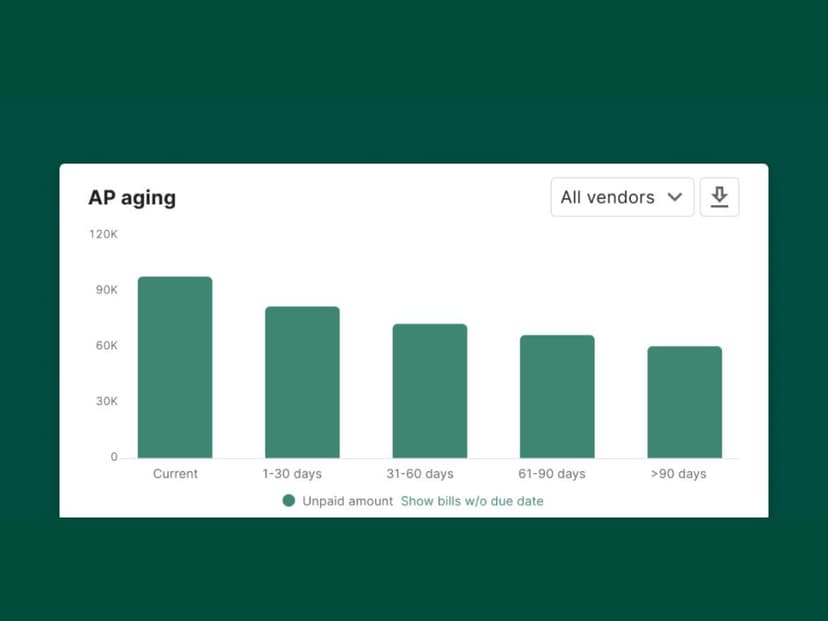

For ecommerce businesses, working capital isn’t just about staying afloat. It’s what powers growth, keeps shelves stocked, and gives you the flexibility to act fast when new opportunities come up — like launching a product, scaling ad spend, or stocking up ahead of peak season. When managed well, strong working capital ensures your cash isn’t tied up in slow-moving inventory or delayed customer payments. It helps you move forward with confidence and balance inventory and cash, even when demand or supply chains shift.

How to Choose the Right Working Capital Solution

Choosing a working capital partner isn’t just about finding the fastest or cheapest option, it’s about making sure the financing structure fits the way your business actually runs. Ecommerce brands have unique cash flow rhythms: upfront supplier costs, fluctuating ad spend, and uneven payout cycles. The best solutions should help you stay ahead of those cycles, not get squeezed by them, and make the right cash flow moves after landing a big order.

Think of this step like building your capital stack with intention. Here’s a practical way to evaluate your options:

1. Start with Your Cash Conversion Cycle (CCC)

Map out when cash leaves and enters your business — inventory orders, production, fulfillment, marketing spend, and sales payouts. Understanding your timing gaps will help you determine how much working capital you need and how quickly you need access to it.

Example: If your suppliers require 50% upfront and your payout from marketplaces takes 30+ days, you need a solution that bridges that gap without creating new pressure points.

Accountants calculate the Cash Conversion Cycle as:Days Inventory Outstanding + Days Sales Outstanding - Days Payables Outstanding = Cash Conversion Cycle

In simple terms — how long you are holding your inventory for plus how long you have to wait to get paid by your customers (especially impactful for omnichannel brands) minus how long you can extend terms with your suppliers.

2. Define Your Use Cases and Growth Goals

Are you trying to fund larger inventory runs, smooth out seasonal swings, or free up cash for marketing? Different solutions are optimized for different goals.

- If your main challenge is inventory financing, look for solutions with extended payment terms.

- If you’re scaling rapidly, flexibility and speed might matter more than the absolute lowest rate.

- If your sales cycles are predictable, structured repayment can work in your favor.

3. Match the Financing Model to Your Business Model

Working capital can come in many forms — invoice financing, merchant cash advances, revenue-based financing, or traditional credit lines.

- Ecommerce-specific financing often aligns with how you operate day to day, offering faster approvals and repayment terms that flex with your sales volume.

- General-purpose financing might offer lower rates but can be harder to qualify for or less tailored to your needs.

4. Evaluate the Partner, Not Just the Product

The right financing partner should understand ecommerce operators. That means fast decision making, clear pricing, simple repayment structures, and a support team that speaks your language. Look for transparent terms, easy integration with your existing tools, and the ability to scale alongside your business.

Pro Tip: Ecommerce operators often benefit most from flexible, non-dilutive funding, especially when funding large inventory purchases or ramping up marketing ahead of peak sales periods.

Key Things to Look For

When evaluating working capital solutions, the right partner can make the difference between fueling growth and creating unnecessary friction. Look for more than just capital, look for alignment with how your business actually runs.

Here are the core qualities that matter most:

Deep understanding of ecommerce and CPG businesses: Not every lender is built for inventory-heavy, fast-moving brands. The best partners understand seasonal demand, long production lead times, and omnichannel sales cycles. That means less explaining on your end and financing that actually fits your operational reality.

Transparent pricing with no hidden fees: Working capital should help you grow, not surprise you with unclear costs. Clear terms, upfront pricing, and no buried fees make it easier to plan margins, manage cash flow, and scale confidently. Watch out for unused facility fees, prepayment penalties or fixed fees that don’t reduce as you repay principal.

Seamless integrations with your existing stack: Look for solutions that plug directly into the platforms you already use, like Shopify, Amazon, QuickBooks, or NetSuite. This not only speeds up approvals but also gives you better visibility into cash flow, payables, and upcoming funding needs.

Flexible repayment terms that match your revenue patterns: Percent of sales based repayments can strain your cash flow and send your effective APR through the roof. The right partner will offer terms that give you control over your repayment cycle and not penalize you if you don’t use the facility during slower months.

Fast approvals and funding when timing matters most: Ecommerce often moves faster than traditional financing can. Quick access to capital, especially ahead of product launches or high-demand seasons, lets you act on opportunities instead of missing them.

Sensible collateral requirements: It’s normal for lenders to require some collateral when they approve financing, but make sure the requests are reasonable. It’s very common for ecommerce financing over ~$200k to require an all assets lien (called a UCC filing in the US). Watch out for lenders who require personal guarantees, equity or warrants against your equity.

Common Challenges

Even the best ecommerce working capital solutions can create friction if they’re not properly aligned with your business model. Ecommerce brands face unique cash flow patterns, seasonal swings, and operational complexities, so it’s important to understand potential pitfalls before committing.

Complex terms: Some financing agreements are full of jargon, variable fees, or hidden costs that can make it difficult to accurately forecast your true expenses. Especially common in ecommerce financing are merchant cash advances (MCAs) that frequently force you to repay daily or weekly as a percent of your sales. What sounds like a simple fixed fee, can actually become a 50+% APR if your business does well. It’s generally recommended to avoid MCAs unless they are your only alternative. Misreading terms can lead to unexpected charges, higher effective interest rates, or repayment surprises that strain your cash flow. Always review contracts carefully and ask for plain-language explanations when necessary.

Slow underwriting: Traditional banks and legacy lenders often operate on timelines that don’t match the fast pace of ecommerce. Lengthy approval processes can mean missed opportunities — like launching a new product, stocking up for a seasonal surge, or funding ad campaigns at peak times. Look for partners who understand ecommerce timelines and can make decisions quickly.

Limited ecommerce support: Many lenders still offer generic financing solutions that aren’t designed for online businesses. Without integrations into your ecommerce platform, accounting software, or inventory management system, you may spend hours manually tracking funding, reconciling payments, or entering data, defeating the purpose of working capital. Purpose-built ecommerce solutions save time, reduce errors, and give you clearer visibility into your cash flow.

Scalability issues: Some solutions work well for early stage startups but can’t keep up as your business grows. If your funding partner can’t scale with your inventory needs, sales volume, or multi-channel operations, you may have to switch providers mid-growth, creating friction and downtime.

8 Things to Consider Before Choosing a Working Capital Partner

When evaluating working capital solutions, it helps to think of the process like a mini audit of your business needs and operational realities. This checklist goes beyond features and risks — it's about making sure the financing you choose truly supports your growth strategy.

- Operational Fit: Not every solution works for every business. Consider whether the funding model aligns with your revenue type, product mix, and sales cycle. For example, a revenue-based lender may be ideal for fast-moving DTC brands, while invoice financing might better suit wholesale-heavy operations.

- Speed to Funding: Timing matters. A solution that takes weeks to approve may leave you scrambling for inventory ahead of seasonal spikes or ad campaigns. Look for partners that can fund in days rather than weeks, and make sure the process scales with your order volume.

- Cost Structure: Beyond the headline rate, examine APR, fees, and potential penalties. Some solutions advertise low rates but add origination fees or hidden costs. A transparent cost structure lets you plan accurately and protects your margins. If you are a seasonal borrower, watch out for lenders who charge unused facility fees — making you pay even when you aren’t borrowing can significantly increase your total cost of borrowing throughout the year.

- Repayment Terms: Flexible repayment aligned with your cash conversion cycle prevents unnecessary cash flow stress. Consider options that give you control over how your repayment term for each loan and make it easy to adjust your repayment schedule if revenues are delayed.

- Scalability: Your funding needs will grow as your business does. Make sure the solution can scale with you — both in terms of higher credit limits and more sophisticated reporting, integration, or operational support — so you don’t outgrow your financing partner.

- Integrations: A working capital solution is most effective when it fits seamlessly into your stack. Check compatibility with Shopify, Amazon, QuickBooks, NetSuite, and other platforms you rely on. Strong integrations reduce manual work, errors, and friction in your cash flow management.

- Transparency: Clear, upfront terms are critical. Avoid partners with vague language, unclear fees, or fine print that hides key details. Transparency not only protects your business but builds trust, making it easier to plan future investments.

- Customer Support: Even the best solutions can hit bumps, especially during peak seasons. Ensure the partner provides reliable, responsive support — preferably with ecommerce expertise — to help you navigate issues quickly and avoid operational disruptions.

The 14 Best Working Capital Solutions for eCommerce Businesses in 2025

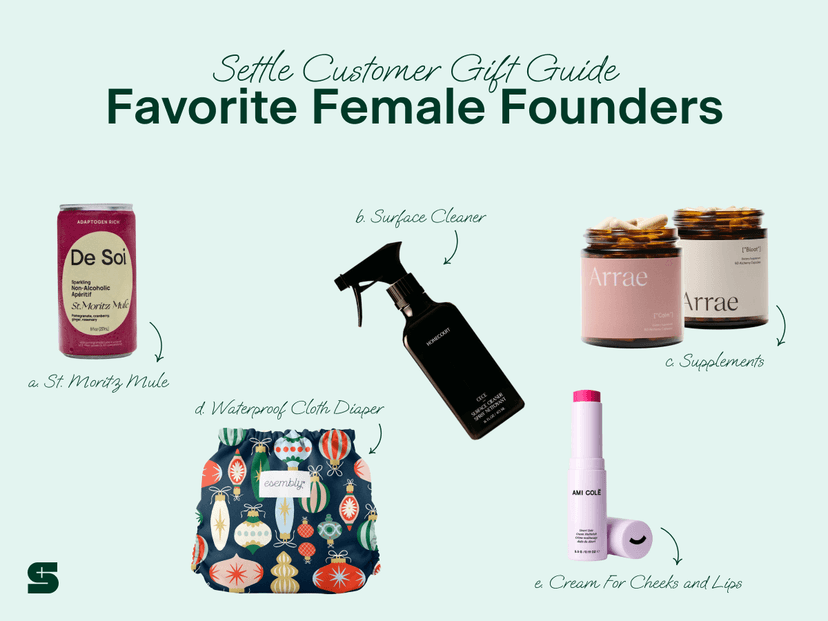

Below are some of the top working capital solutions trusted by ecommerce and CPG businesses in 2025, with a clear breakdown of what they offer, who they’re best for, and what to keep in mind.

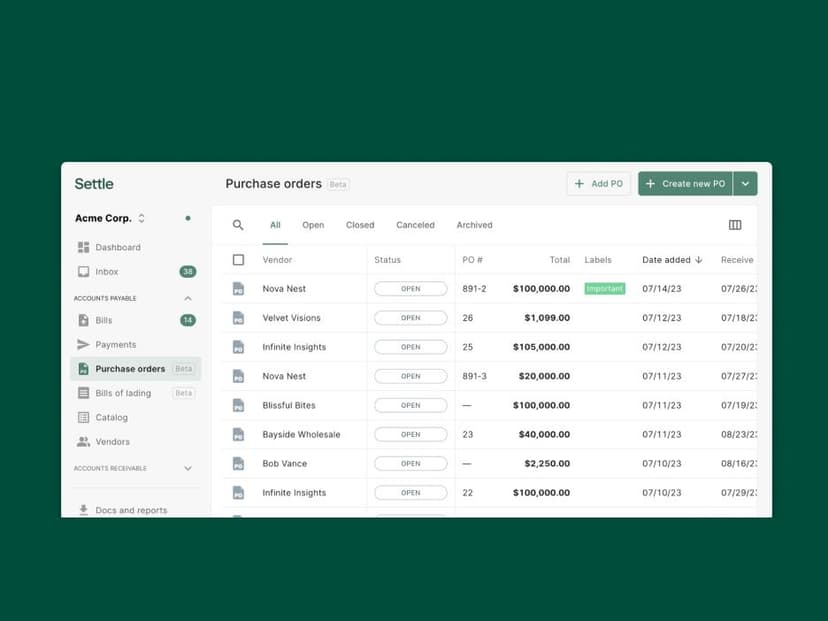

1. Settle

Website: settle.com

Best for: Both small, emerging CPG businesses and larger, scaling ecommerce businesses managing large inventory purchases, scaling marketing spend, and seasonal peaks. Works well for brands needing integrated financial visibility alongside operational tools.

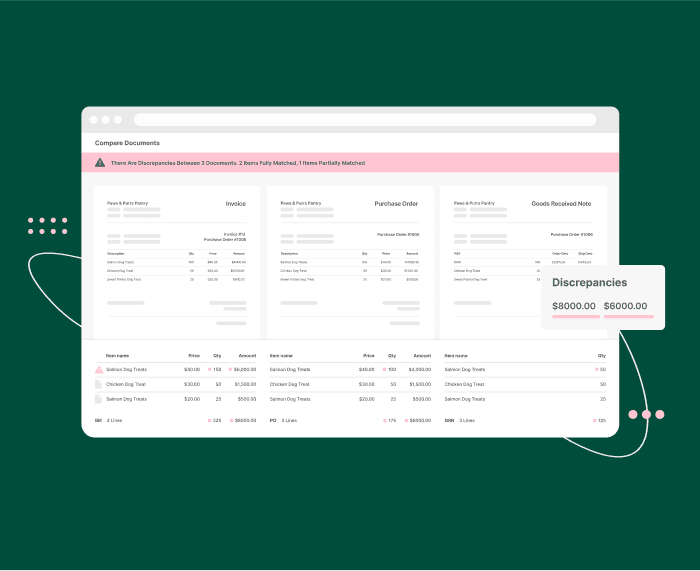

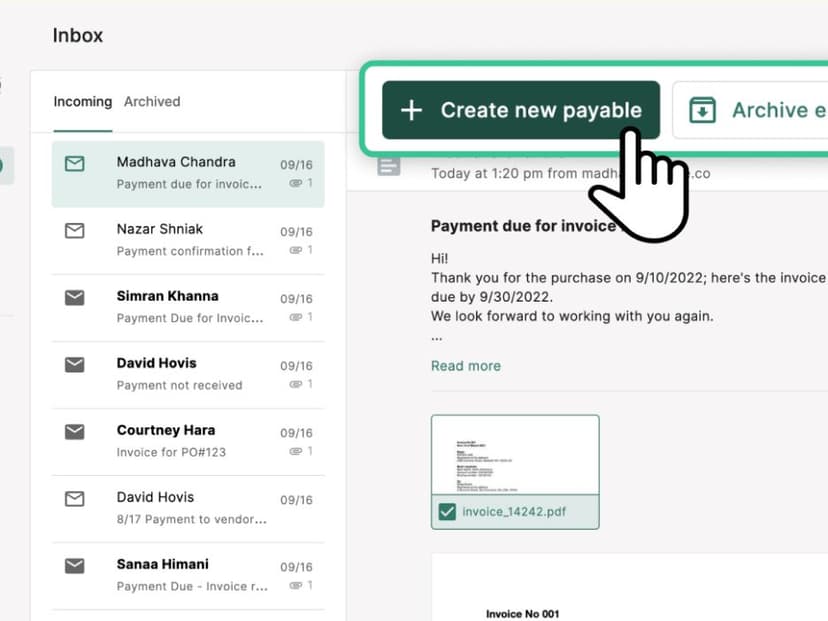

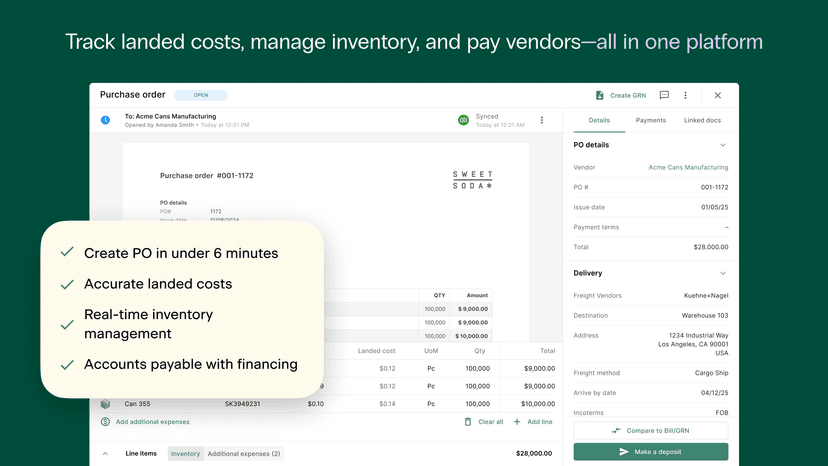

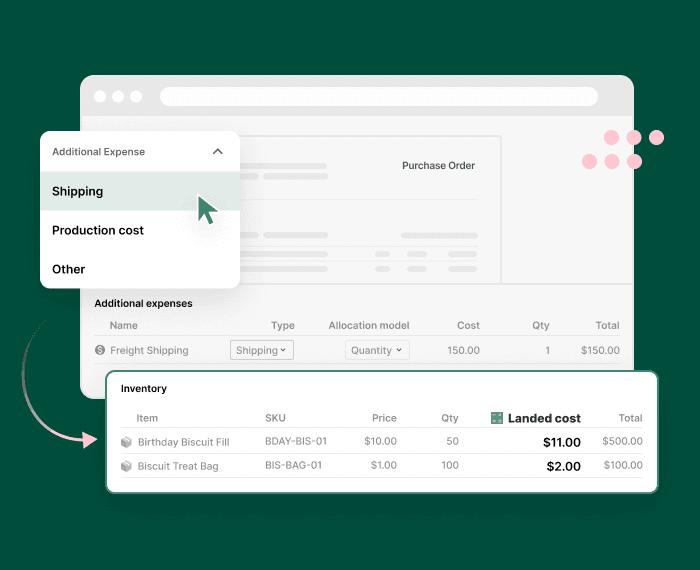

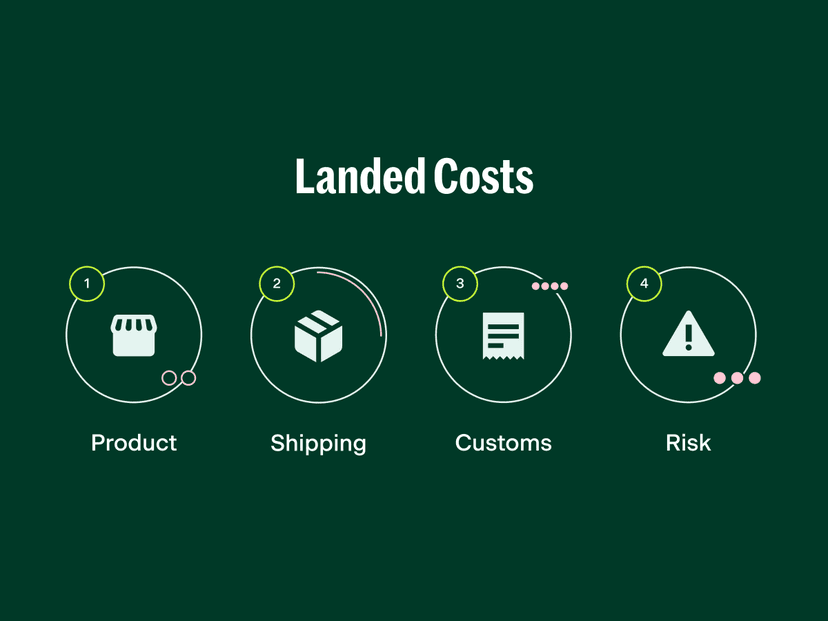

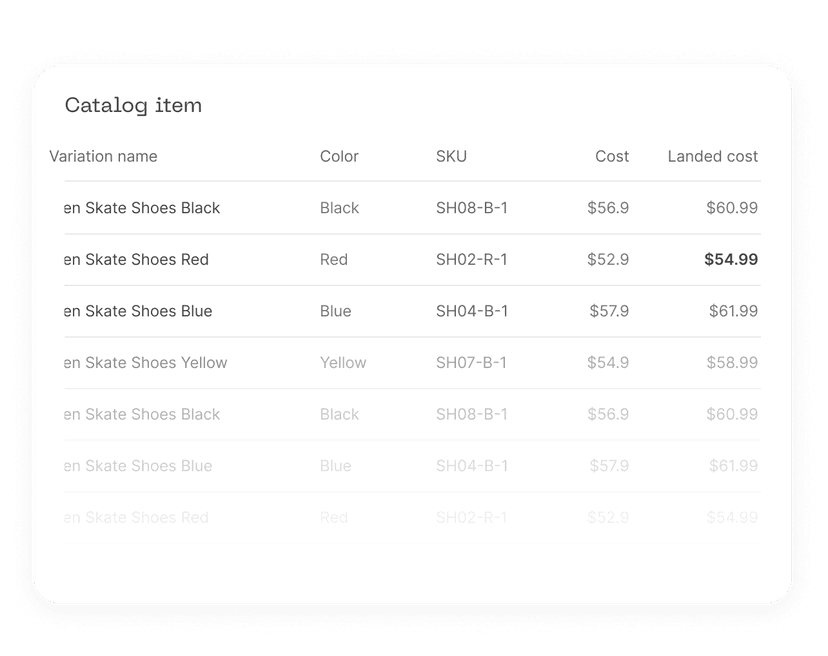

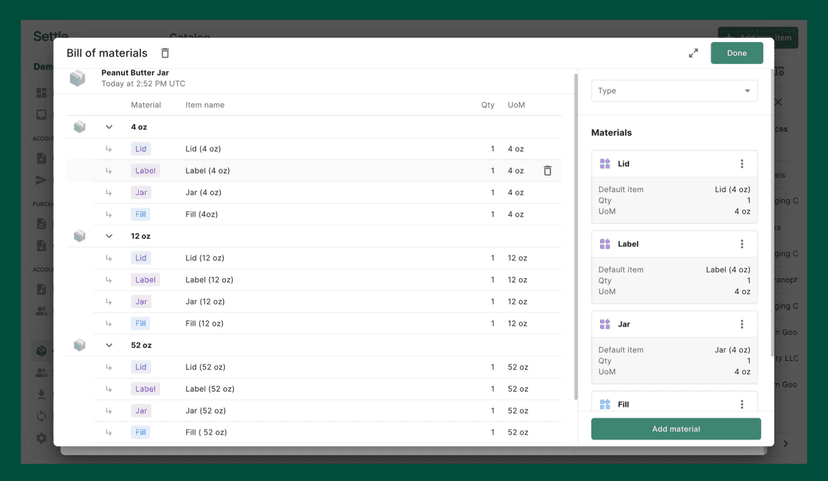

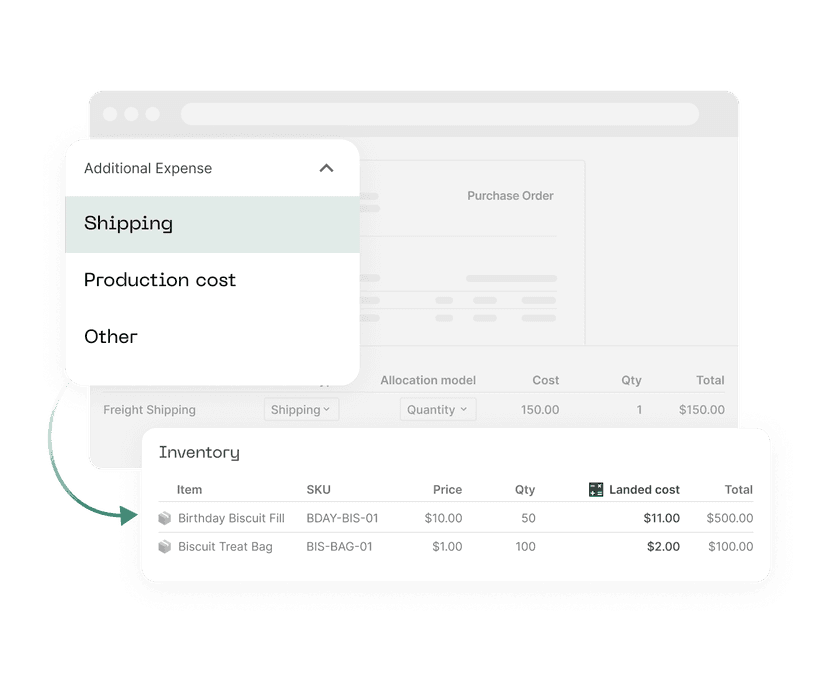

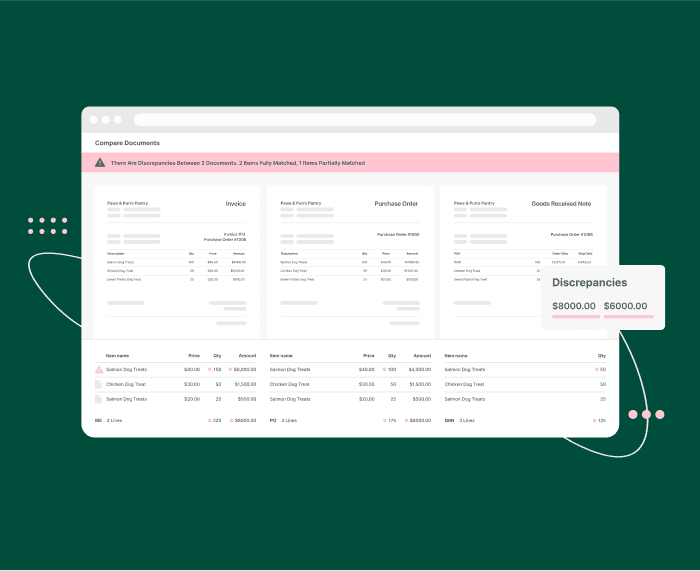

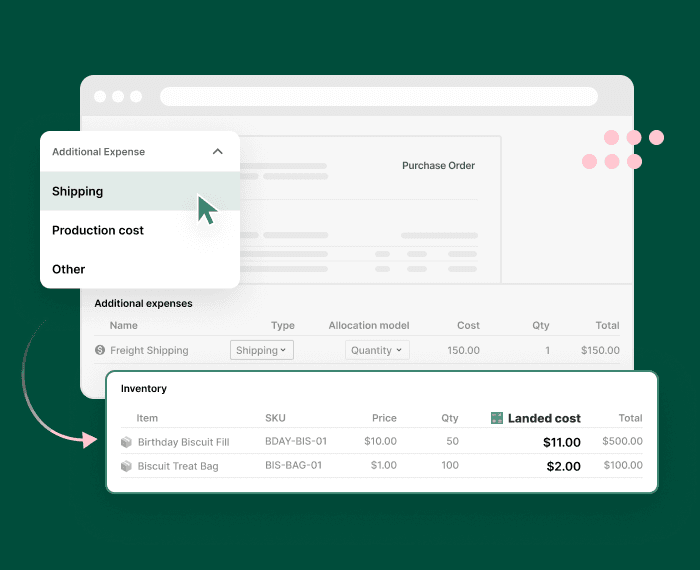

How it works: Settle provides flexible working capital that allows businesses to pay suppliers upfront while extending repayment terms. Purpose-built for ecommerce operators, you simply pay your bills and choose which ones to extend with Settle. Settle pays your vendor and you repay Settle on the terms that you select. It allows you to only use as much as you need at any time, with no unused facility fees or prepayment penalties. Settle also integrates directly with your existing stack for clear cash flow visibility and helps you automate purchase order management, accounts payable, and cash flow forecasting.

Pros:

- Flexible working capital between $20K-$15M

- Competitive APRs between 12-24%

- Only pay for what you use, no prepayment penalties and no unused facility fees

- No daily percentage of sales to pay back

- Fixed monthly payments for predictable cash flow forecasting

- Embedded financial insights for better decision-making

- Non-dilutive — no personal guarantees and no requirement to give equity

- AI-powered underwriting that looks deeper than balance sheets

- Seamless integrations with Shopify, Amazon, QuickBooks, NetSuite, and other sales channels

Cons:

- Not designed for pre-revenue brands

2. Onramp

Website: onrampfunds.com

Best for: Ecommerce sellers seeking quick, short-term funding to cover inventory or marketing expenses.

How it works: Onramp provides working capital that is automatically tied to your sales performance. Funds can be deployed rapidly to cover operational spikes, and repayment adjusts with your revenue.

Pros:

- Simple, automated repayments

- Quick access to capital for short-term needs

- Easy onboarding for ecommerce platforms

Cons:

- Repayment terms can be tight for seasonal brands

- Less suitable for long-term growth planning

3. Kickfurther

Website: kickfurther.com

Best for: Businesses that prefer inventory-specific financing and connecting with backers to fund production.

How it works: Kickfurther connects brands with a network of backers who fund inventory production. Repayment occurs once the inventory is sold, making it non-dilutive and flexible for product-focused businesses.

Pros:

- Flexible, non-dilutive capital

- Ideal for inventory-heavy businesses

- Funding tied to actual sales rather than fixed schedules

Cons:

- May not cover broader working capital needs beyond inventory

- Depends on inventory moving quickly to free up cash

4. Shopify Capital

Website: shopify.com/capital

Best for: Shopify merchants looking for embedded financing directly in their ecommerce platform.

How it works: Shopify Capital provides funding through your Shopify account, with automatic repayments taken as a percentage of daily sales. This simplifies repayment and keeps cash flow aligned with revenue.

Pros:

- Easy access for Shopify sellers

- No fixed monthly payments

- Quick approval process

Cons:

- Limited to Shopify ecosystem

- Not suitable for multi-platform sellers

5. Clearco

Website: clear.co

Best for: DTC businesses focused on marketing and rapid growth.

How it works: Clearco provides revenue-based financing, giving brands access to capital in exchange for a share of future revenue. Ideal for scaling ad spend or inventory purchases without giving up equity.

Pros:

- Non-dilutive funding

- Quick approvals

- Flexible repayment tied to revenue

- Supports rapid marketing or inventory campaigns

Cons:

- Higher effective cost if growth is faster than expected

- Limited for wholesale-heavy models

6. Wayflyer

Website: wayflyer.com

Best for: Fast-growing ecommerce businesses with predictable revenue streams needing flexible funding.

How it works: Wayflyer uses a merchant cash advance model and offers revenue-based financing with repayment tied to sales performance, providing flexible working capital without fixed schedules.

Pros:

- Tailored for ecommerce operations

- Quick funding

- Supports scaling inventory and marketing

Cons:

- Merchant cash advance structure often results in high effective APRs

- Repayments fluctuate with sales

- Less suited for very early-stage brands

- Cannot use as much or little as needed

7. FundThrough

Website: fundthrough.com

Best for: B2B ecommerce businesses waiting on invoice payments or dealing with wholesale channels.

How it works: FundThrough offers invoice factoring, turning unpaid invoices into immediate cash flow. This allows brands to cover operational expenses without waiting 30–90 days for client payments.

Pros:

- Fast access to cash tied up in receivables

- Supports wholesale or B2B operations

- Helps smooth cash flow cycles

Cons:

- Fees can add up with frequent use

- Not optimized for DTC businesses

8. Dwight Funding

Website: dwightfunding.com

Best for: Businesses scaling through wholesale or B2B channels needing larger funding amounts.

How it works: Dwight combines inventory and receivables financing for CPG and ecommerce brands, giving flexibility across multiple financing needs.

Pros:

- Strong B2B financing expertise

- Supports larger funding requirements

- Flexible structure for multi-channel operations

Cons:

- Not ideal for early-stage or pre-revenue businesses

- Less tailored for pure DTC brands

- Time consuming monthly reporting

- Must have inventory in the warehouse or invoiced receivables in order to borrow

9. OnDeck

Website: ondeck.com

Best for: Small ecommerce businesses seeking quick loans or lines of credit.

How it works: OnDeck provides term loans and revolving credit with fast approvals, allowing businesses to cover immediate expenses or seize growth opportunities.

Pros:

- Rapid funding

- Flexible loan sizes

- Clear repayment terms

Cons:

- Higher interest rates for some borrowers

- Less flexible for seasonal revenue cycles

10. Fundbox

Website: fundbox.com

Best for: Businesses looking for short-term revolving credit lines.

How it works: Fundbox offers fast-approval credit lines that can be used flexibly for payroll, inventory, or other operational needs.

Pros:

- Flexible credit line

- Quick decisioning

- Easy to draw and repay

Cons:

- Smaller credit limits for some businesses

- Better suited for predictable cash flow

11. Payability

Website: payability.com

Best for: Marketplace sellers on Amazon, Walmart, and similar platforms.

How it works: Payability advances funds from marketplace sales, giving brands daily access to cash flow rather than waiting for platform payouts.

Pros:

- Daily payouts

- Smooths delayed marketplace payments

- Easy integration with marketplaces

Cons:

- Fees can accumulate

- Limited to marketplace sellers

12. 8fig

Website: 8fig.co

Best for: DTC businesses with long cash conversion cycles and inventory-heavy operations.

How it works: 8fig provides continuous funding tied to your supply chain, helping brands scale inventory without cash flow gaps.

Pros:

- Tailored funding schedules

- Focused on ecommerce and CPG

- Supports predictable growth plans

Cons:

- Requires stable, predictable revenue streams

- Less suited for very early-stage businesses

13. Traditional Bank Financing

Best for: Established businesses with long operating histories and strong financials.

How it works: Traditional banks offer term loans and lines of credit, typically at lower interest rates, but with stricter underwriting requirements and slower approvals.

Pros:

- Lower rates for qualified borrowers

- Higher funding limits

- Long-term stability

Cons:

- Slow application and approval process

- Strict qualification criteria

- Less flexible for seasonal or fast-moving ecommerce brands

- Does not offer flexible loan amounts

- Charges fees for unused faculty

- Requires personal guarantees

- Complicated monthly reporting

- Cannot finance inventory before it lands

14. Asset-Based Lending (ABL)

Best for: Businesses with significant assets such as inventory, receivables, or equipment.

How it works: ABL uses your assets as collateral to secure flexible working capital, allowing brands to borrow against inventory or receivables.

Pros:

- Higher borrowing limits

- Flexible structure for scaling operations

- Useful for inventory-heavy businesses

Cons:

- Requires strong balance sheet and collateral

- More complex and slower documentation and approval process

- Not ideal for small or early-stage businesses

- Charges fees for unused faculty

- Requires personal guarantees or equity

- Complicated monthly reporting

- Cannot finance inventory before it lands

Why Settle Wins

Instead of piecing together financing from multiple lenders, Settle gives ecommerce and CPG businesses a single, integrated platform to manage growth. With Settle, you can fund inventory upfront, extend payment terms, and maintain healthy cash flow — all while keeping your operational workflows aligned and transparent.

Where most working capital providers stop at lending, Settle goes further by embedding financing directly into your procurement and payments stack. This means you gain full visibility over your cash flow, automate accounts payable, and manage supplier payments seamlessly, so you can take on larger opportunities without stretching your balance sheet.

By combining fast, flexible funding with purpose-built ecommerce integrations, Settle frees your team to focus on scaling the business instead of chasing spreadsheets. Transparent terms, actionable insights, and unified operations give brands smarter data, stronger cash flow, and the confidence to grow fearlessly. Talk to a Settle financing expert.